A credit memo, also known as a credit note, is a financial document that a seller issues to a buyer to provide a credit against the amount owed for goods or services previously purchased. Although creating a credit memo is not that easy, that’s where OnlineCheckWriter.com – Powered by Zil Money comes in, and our platform helps you create a credit memo easily from the comfort of your home or office. Keep reading to know more about credit memos and the best platform for creating credit memos quickly.

What Is a Credit Memo?

A credit memo is a document that a seller issues to a buyer to provide a credit against the amount owed for goods or services that were previously purchased. It is used in situations where the seller has made an error in invoicing or where there is a dispute over the quality or quantity of goods or services provided.

A credit memo is a negative invoice, which reduces the amount owed by the buyer to the seller. It usually has information like the number of the original invoice, the reason for the credit, the amount of the credit, and any other relevant information.

Types of Credit Memos

- Price Dispute Credit Memo

Price disputes are one of the most common reasons for issuing credit memos. Prices are frequently changed after the transaction is completed; in such cases, the seller issues a credit note to the buyer.

- Refund Credit Memo

Sometimes, you have to deal with defective or damaged products and refund your customers. Because you cannot return a transaction once it has been sealed, a credit memo is issued in this case.

The reason for the refund could also be different, such as incorrect supplies or inappropriate goods.

- Marketing Allowance Credit Memo

Marketing Allowance Credit Memos are typically used when a seller offers a marketing allowance or discount to a buyer as part of a promotion or marketing agreement. The credit memo is issued to reduce the amount the buyer owes to the seller in recognition of the provided marketing allowance or discount.

- Internal Credit Memo

Internal credit memo is an alien term to many because not all business owners know it. It is a type of document used to write off a receivables balance. The copy of an internal credit memo remains with the seller and is not sent to the buyer because its sole purpose is inventory tracking.

- Bank Credit Memo

A bank credit memo is different from other credit memos because it can only be given by a bank. A bank credit memo is a piece of paper sent to a customer by the bank.

- Overstated Credit

Overstated credit is a situation where credit is recorded in excess of the actual amount owed or the agreed-upon credit amount. In other words, an overstated credit occurs when a credit memo is issued for an amount higher than the actual amount owed or agreed upon by the parties involved.

Overstated credits can occur due to various reasons, such as human error, incorrect calculations, miscommunication, or misunderstandings between the parties involved.

Why Is a Credit Memo Issued?

A credit note can be given to a buyer for many different reasons. One reason could be that the item was broken, the wrong size or color, or that the customer changed his mind.

A seller could also send a credit memo if the price drops. For example, when a customer buys a product and gets a discount a day later, this is what happens. The difference between the price you paid and the new price with the discount is shown on the credit memo.

You will need expert advice on how to take care of everyday business and accounting needs. However, there will be times when you need to use good resources that you can trust to make your work easier. It will help your business, save you time, and give you and your customers much more to discuss.

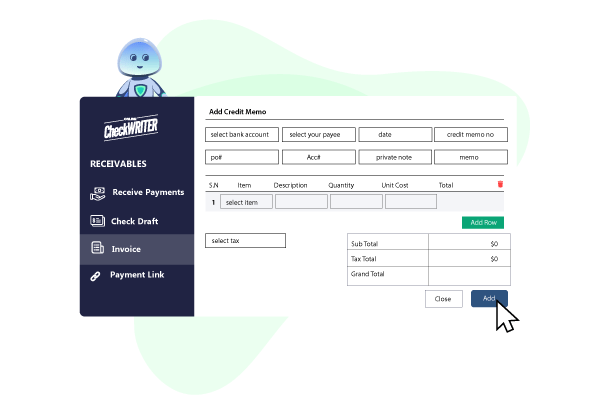

How are Credit Memos Created with OnlineCheckWriter.com?

Credit memos can be created manually or automatically, depending on the accounting system being used. Usually, the credit memo is created in the same system used to create the original invoice.

You can also create credit memos automatically. OnlineCheckWriter.com is the best platform for creating credit memos.

The credit memo function of OnlineCheckWriter.com can save you a lot of time. First, click on the credit memo, select the customer, and add the credit amount. Then, when you issue an invoice to this customer next time, it reminds you automatically of the credit you added to apply either in full, in part, or to extend to the next invoice.

Credit memos are an important tool for sellers to use when there is an error in invoicing, a dispute over the quality or quantity of goods or services provided, or when goods or services are returned. OnlineCheckWriter.com is the perfect platform for creating the best credit memos and other online tools for all your business purposes. In short, our platform is the best finance management tool for all your business purposes.