When it comes to navigating the banking world, understanding the basics can make a world of difference. One fundamental element is the account number, which is vital information for various transactions. But one might wonder “Where is the account number on a check?”

Locating One’s Financial Identity

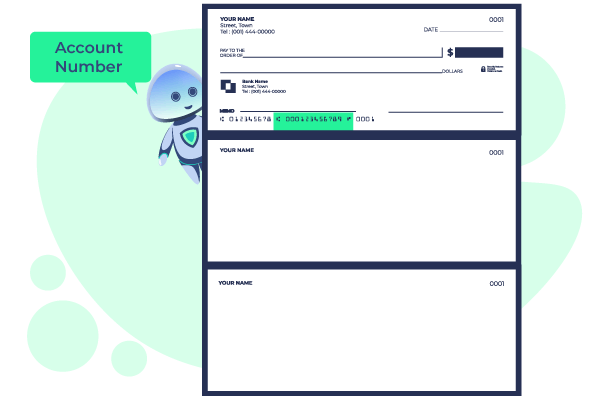

At the bottom of a standard bank check lies a treasure collection of information. Located between the nine-digit routing number and the check number belongs to the account number. This series of digits is unique to one’s account, similar to the financial fingerprint. Depending on the bank, the sequence varies in length, typically 8 to 12 digits.

Interpreting the Check Components

Understanding the details of a check is key to spotting one’s account number. The routing number, denoting the financial institution, precedes the account number. It serves as the GPS for directing funds to the correct bank. Following this is the user’s account number, often accompanied by symbols like dashes or spaces, enhancing readability and organization.

Zeroing In on the Account Identifier

Identifying the account number might seem tiring among the wide range of figures on a check. However, the set of digits between the routing number and the check number carries one’s financial identity. While the routing number sets the stage for the bank, the account number specifically pinpoints the individual account.

Ensuring Accurate Transactions

Accuracy in transcribing the account number is essential. Whether for direct deposits, setting up automatic payments, or wire transfers, providing the correct account number ensures flawless financial transactions. Verifying the number before sharing it for transactions adds an extra layer of security and prevents potential errors.

Conclusion: Empowerment Through Knowledge

OnlineCheckWriter.com – Powered by Zil Money offers a digital solution that makes check management easy. The platform improves tasks like check printing and management, enabling easy access to essential details like account numbers. With user-friendly features, it’s a valuable tool for businesses and individuals looking for efficient check handling in the digital realm.

Understanding where to find the account number on a check is a foundational step in managing one’s finances. This knowledge makes ensuring precision in financial transactions a simple yet vital task. Whether setting up electronic payments or confirming account details, recognizing the importance of this sequence of digits encourages financial security and peace of mind.