The statistics point out the fact that in the United States, transactions between banks have grown in popularity. Two unique strings of numbers that have underpinned this process intact are 1. Account Number and 2.Routing Number. Both these number factors promise to have a major role to make all sorts of banking transactions safe and fast. The digitalized era of banking even depends on these two unique identification numbers that help in processing checks. A Routing Number is very important in banking transactions. It consists of a nine-digit code which is based on the location of the particular bank in the United States where a customer’s account was opened.

In short, the ABA /Routing Number is considered as the numerical address of your banking institution, and this especially holds true as it helps to identify which bank and which branch a customer is doing business with. While submitting a check in any of the Banks in the United States, there will be confusion among the bank workers regarding the bank’s names and addresses. The reason behind this is that there will be a potential similarity between the banks’ names and also there will be some confusion regarding the branch. However, these nine digits Routing Number assigned to a particular bank or credit union serves as a numerical address. The idea behind Routing Number is that the check can be sent to that particular branch with that particular Routing Number without any hassles.

Click Here For Interactive Demo ⬇

Online Check Writer

Key figures

1M+

online business accounts

88B+

transaction volume

16M+

checks processed

How can one identify the ABA/Routing Number of a particular bank in the United States?

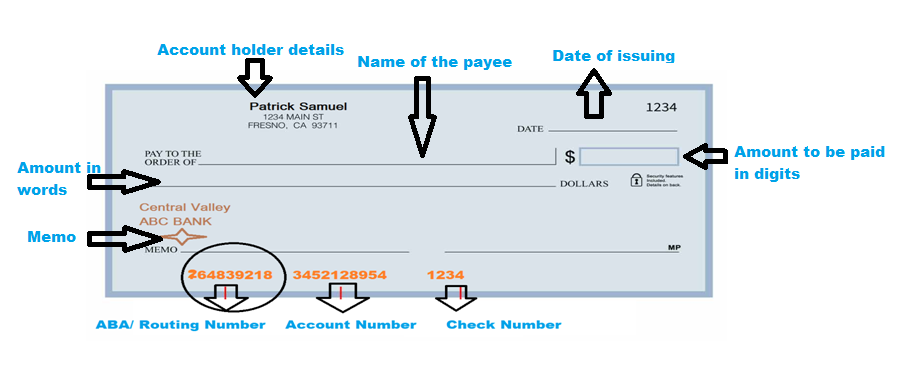

Every check issued for the banks of the United States carries specific banking details such as Bank Account Number, Bank Routing Number, and check number along with other required details such as payee name, memo, date and the amount to be debited. The three sequences of the number located at the bottom of the check are Account Number, the Routing Number, and the Check number. While taking a look at the details, the Routing number will be located at the bottom left-hand corner of a check and it consists of nine digits. Usually, the Bank Routing Number starts with 0, 1, 2, or 3.

Without a check, one can understand the Routing Number by visiting the website of that particular bank and for this purpose, the customer has to sign in to his online banking account and then proceed to “ account information” where the Routing Number will be displayed. Contacting the customer representative of the bank will also help in receiving the Bank Routing Number. It is to be noted that a single bank will have more than one Routing Number based on the number of locations. However, two different will never have the same Routing Number.

What is the requirement of ABA/ Routing Number in day-to-day banking transactions?

The good news is ABA/ Routing Number or else referred to as Routing Transfer Number has a lot of functions in its list. In the day-to-day banking transaction process, there will be a handful of organizations that ask for your Routing Number. In the case of a payment made over the phone or any transactions that are done online, your bank routing number will be required. It can also be used while making automatic bill payments where the routing number and Account Number are needed.

In another scenario, when a check is processed or an international money transfer has been done, the bank Routing Number will be needed to get a clear idea regarding where the money needs to go. Your bank will be able to provide the Routing Number for the tasks such as Direct Deposit, Automatic bill payment, Check Processing, and other payment services. It’s important to remember that in the case of wire transfer may be the routing number provided by the banks will be different and hence you have to check it out. During the wire transfer, it is good to re-check the Routing Number to avoid delays in processing.

Making a comparison between ABA Bank Routing Number and Bank Account Number

While checking for the year when both the Routing Number and Bank Account Number have been started, it can be seen that the concept of the Routing Number has started much before the bank Account Number. It is said that the process of Routing Numbers has been started by the year 1910 by the American Bankers Association (ABA) in order to avoid any confusion regarding the cashing of checks and was one better way to adapt to the changing transaction scenario.

The process of including bank Account Numbers was started much after the introduction of the Routing Numbers. Both the Routing Number and Account Number are vital as far as banking-related financial transactions are concerned. The purpose of both is the identification of customer banking details. Key points to remember are that the Routing Number helps to identify the bank and the branch while the Account Number helps to identify into which account the money should go. Bank Routing Number usually consists of a nine-digit code based on the bank’s location where an account has been opened while the bank Account Number will have 10 to 12 digits specifying the personal account.