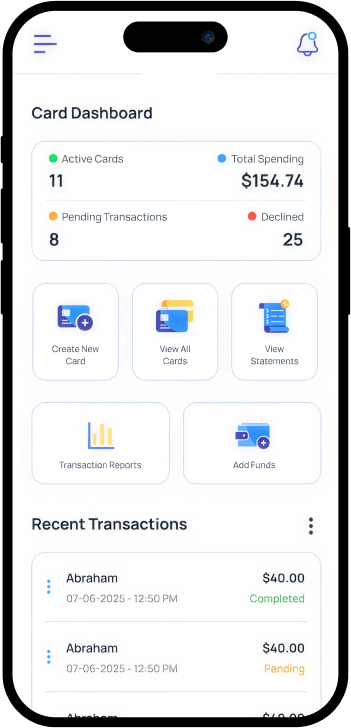

Generate Bulk Virtual Cards in Minutes

Manage virtual cards in bulk for your teams and vendors with ease. You can instantly create, freeze, or delete any card without disturbing the rest, and implement smart restrictions to ensure maximum security by controlling card use based on time and location.

What sets us apart

Empower Your Team

Invite trusted managers, set approval rules, and track card usage with automatic notifications.

Define Usage Zones

Set time and location limits on cards for precise control over how and when funds are spent.

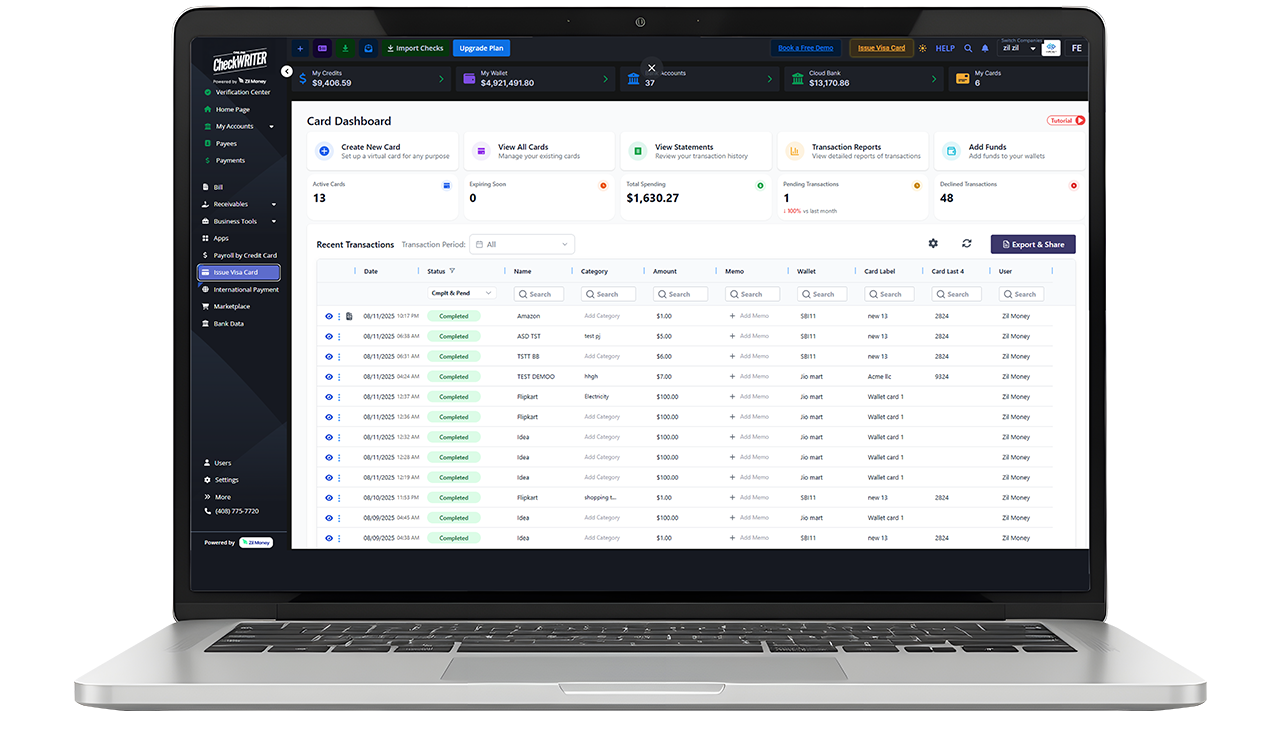

Instant Report Generation

Manually upload receipts, then let AI take over and create detailed, accurate expense reports.

Total Spend Control with Custom Virtual Cards

Issue unlimited corporate virtual cards in minutes, set strict vendor or merchant category limits, and ensure funds are always spent where intended.

One-Tap Checkout and Smart Card Restrictions

Push cards to Apple Pay or Google Pay for biometric checkout, restrict use by location or time, and freeze any card instantly without affecting others.

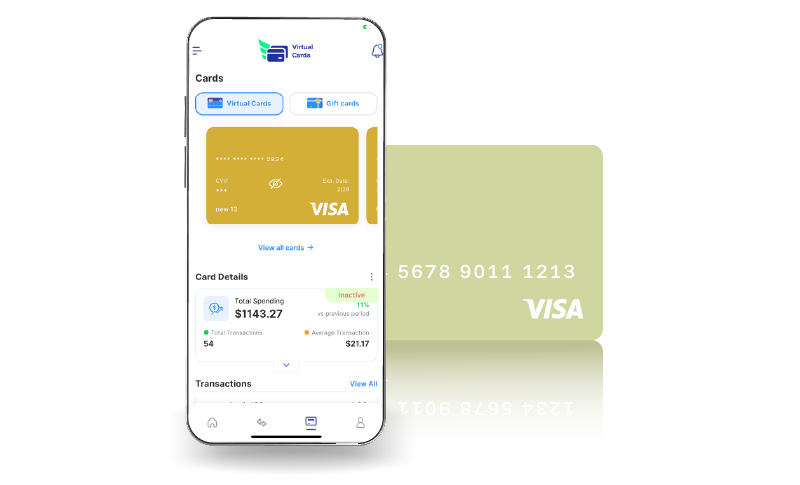

Power Up Your Purchases with Virtual Visa Card

The New Standard in Payments

Virtual Cards with Instant Access, Enhanced Security, and Powerful Analytics

Payment Power in Seconds

Create your virtual cards right away for immediate access to payment tools.

Optimize Your Budgeting

Gain instant insights into spending patterns with comprehensive reporting tools.

Automatic Card Expiration

Set virtual cards to automatically expire after a specified period for added security.

Custom Access for Each User

Assign specific permissions to team members for controlled access to virtual card features.

Quick Data Integration

Easily export transaction data to your accounting system for simplified financial tracking.

Easy Card Reusability

Reissue or renew virtual cards quickly to ensure uninterrupted and secure transactions.

ABOUT US

Get To Know More About The Platform

Power up your B2B payments with OnlineCheckWriter.com – Powered by Zil Money. This advanced platform unifies virtual cards, international payments, credit card payroll, ACH, wire transfers, and check printing into a single, intuitive hub, revolutionizing how you manage your business’s finances.