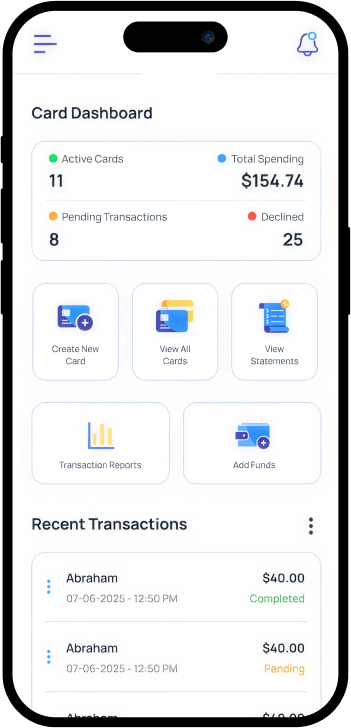

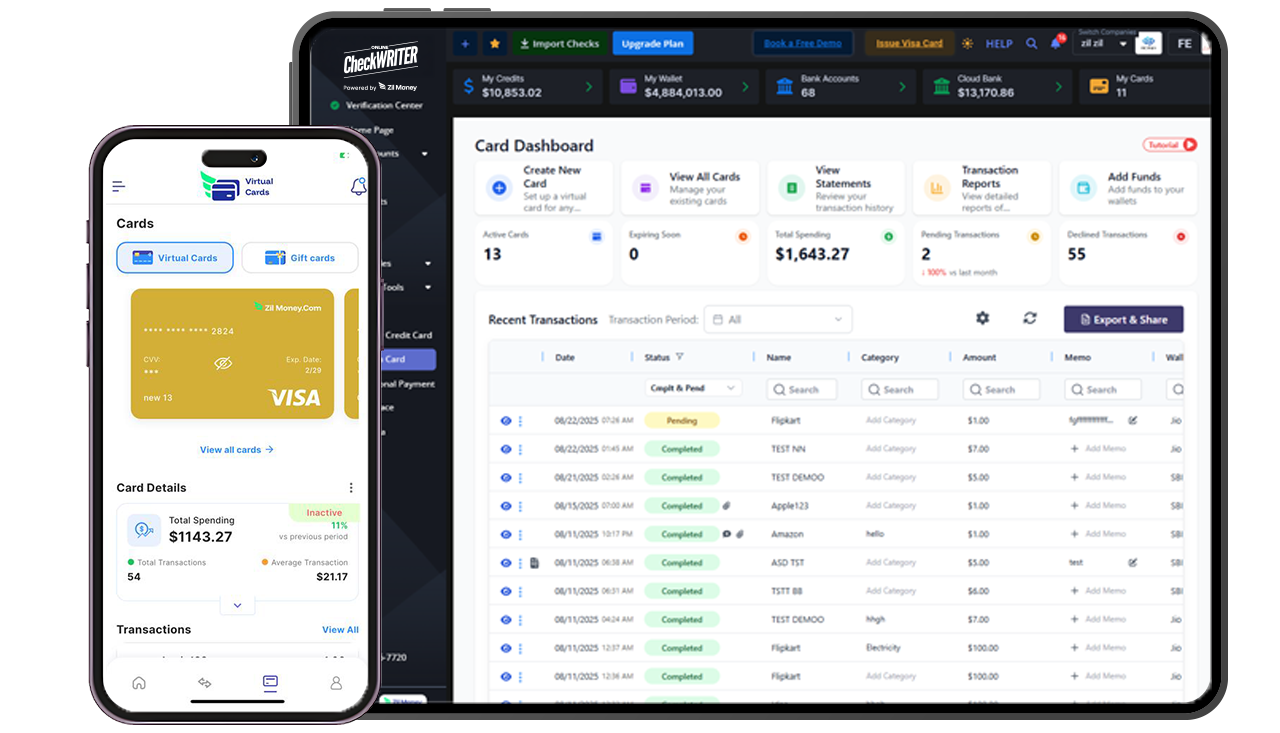

Corporate Virtual Cards Designed for Smarter Control

Easily create Corporate Virtual Cards with spending limits, location-based controls, and enhanced security. Track expenses instantly with automated receipt capture.

OnlineCheckWriter.com- Powered by Zil Money is a financial technology company, not a bank. OnlineCheckWriter.com offers banking services through partnership with FDIC member banks Texas National Bank. Customers are not directly insured by the FDIC – but through the pass-through coverage of our partner banks and is conditional on proper titling, record-keeping, and custodial arrangements.

Bank-Grade Security and Fraud Protection

Protect your payments with industry-leading security features designed for modern business transactions.

Advanced Fraud Protection

Multi-layer security monitors every transaction with real-time fraud detection and prevention.

Granular Spending Controls

Set precise spending limits, merchant restrictions, and geographic controls before cards are used.

Instant Alerts and Monitoring

Get real-time notifications for every transaction with detailed usage analytics and suspicious activity alerts.

Financial Oversight Made Easy with AI Insight

Quickly create, freeze, or delete corporate virtual cards with unique 16-digit numbers. Set approval workflows, budget alerts, and role-based access for full control. AI-driven receipt parsing ensures clear financial tracking.

Instant card creation, freezing, and deletion

Customizable workflows, alerts, and access controls

AI-powered receipt parsing for financial oversight

How It Works

Get Started in Three Simple Steps

Create Account

Sign up in minutes with just your email. No complex paperwork required.

Generate Cards

Create virtual cards instantly with custom limits and controls.

Start Using

Use cards for online purchases, subscriptions, and vendor payments with full security.

Smart Expense Tracking with AI

Revolutionary AI-powered receipt parsing and automated spending analysis that transforms how you track expenses.

AI Receipt Parsing

Upload receipts and get automatic data extraction with expense categorization

Automated Reports:

AI analyzes spending patterns and generates detailed insights within seconds

Smart Categorization:

Automatically categorize transactions by vendor, category, and employee

Compliance Ready:

Generate audit-ready reports with itemized purchase breakdowns

Trusted by Over 1 Million Businesses

Join growing companies that trust OnlineCheckWriter.com for secure virtual card solutions.

1M+

Active Business Accounts

100B+

Transaction Value Processed

15M+

Virtual Cards Generated

Ready to Get Started?

Join thousands of businesses already using our secure virtual cards for their online payments.

Frequently Asked Questions

Common questions about our cross-border business payment services and B2B platform