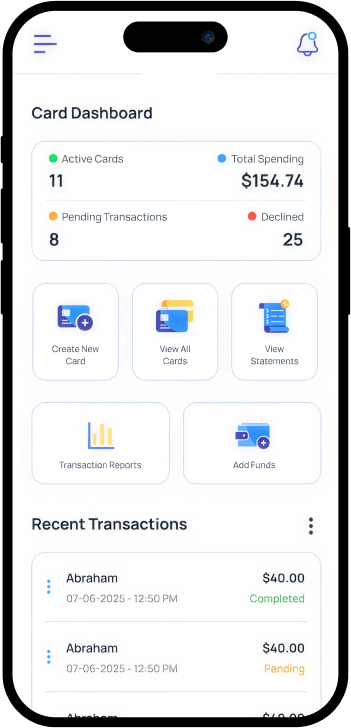

Instant Mass Card Deployment with Complete Control

Grant your team spending freedom, without losing control over financial limits. You can deploy multiple cards in seconds, set granular controls on spending, and track every transaction in real time. With AI-powered receipt processing, transactions are automatically categorized and detailed expense reports are created.

Experience the Difference with Us

Rapid Deployment

Quickly issue and distribute a large volume of cards at once.

Targeted Restrictions

Implement spending rules based on merchant, time, and location.

Smart Automation

Use AI to categorize transactions and capture receipts automatically.

Deploy Virtual Cards with Precise Time and Location Rules

Instantly create multiple virtual Visa cards directly from your funded wallet. Deploy location-specific cards that only work where you need them, with geolocation restrictions limiting usage to specific countries, states, or even cities for enhanced security. Set time-of-day rules to restrict purchases to specific hours or days of the week.

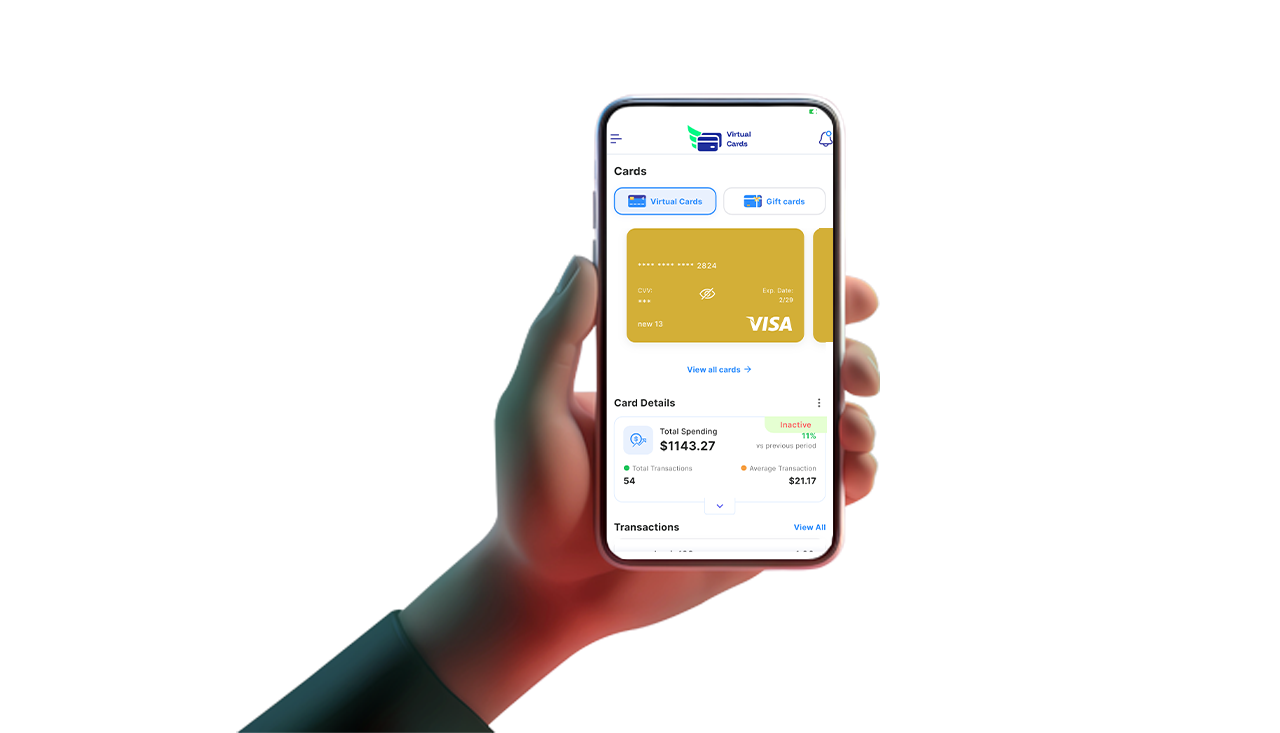

AI-Powered Expense Management with Actionable Insights

Track and manage company spending as it happens, filtering by vendor, category, or user. Instantly freeze or unfreeze cards and use automated, AI-powered receipt capture to create comprehensive, itemized purchase reports. Add your virtual card to Apple Pay or Google Pay for immediate, secure contactless payments.

Activate Multiple Virtual Cards for Your Team in Minutes!

Your Business, Your Control

A Flexible Platform for Modern Spending

Batch Card Creation

Generate a batch of virtual gift cards effortlessly using the Virtual Card API.

Spending Control Rules

Control spending based on merchant, location, and specific rules you define.

Instant Financial Insights

Get immediate access to real-time analytics and detailed reports of your expenses.

AI Receipt Categorization

Automate receipt capture and classification using AI for accurate financial records.

Wallet Integration

Enable collaboration with multiple managers to manage approvals and oversight.

Easy Payment Integration

Seamlessly integrate with Apple Pay and Google Pay for hassle-free transactions.

Smarter Procurement

Simplify Your Buying Process

Transform your company’s purchasing and expense management. With mass card deployment, you can create cards with pre-approved limits for specific purchases or projects. This empowers your team to acquire necessary items quickly while maintaining strict financial control.