In the realm of managing personal finances, one vital but often unpopular practice is bank reconciliation. This financial operation holds remarkable potential in safeguarding one’s monetary health and promoting a clearer understanding of the financial landscape. The process involves aligning one’s personal records with bank statements, ensuring accuracy, and identifying any complexities that may exist.

Understanding Bank Reconciliation: A Fundamental Practice

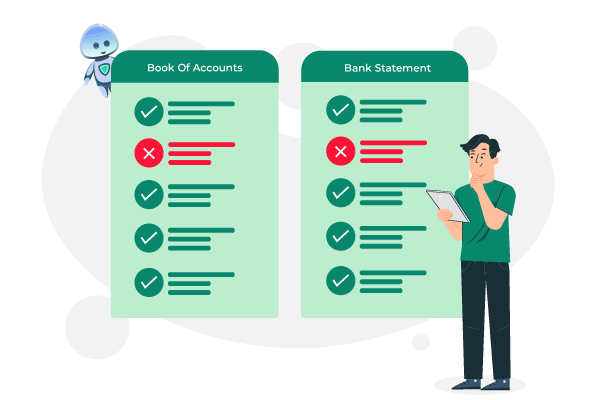

Bank reconciliation isn’t merely a chore but a fundamental practice that empowers individuals to take charge of their finances. By summing all bank account transaction data into one place, the bank reconciliation process eases the alignment of users’ records with those of their bank. It acts as a bridge between one’s financial records and the official statements provided by one’s financial institution.

Identifying Complexities: Shielding Finances

One of the vital roles of bank reconciliation lies in its ability to spot errors. Any inconsistencies or errors can be properly identified through careful comparison between the records and the bank’s statement. These could range from unauthorized transactions to bank fees or even errors in recording. This active approach shields the finances from risks and unauthorized activities.

Enhancing Financial Accuracy: A Precision Tool

The precision offered by bank reconciliation is exceptional. It ensures that every transaction, no matter how minute, is accounted for and accurately reflected in the records. This accuracy encourages a clear understanding of the financial standing and helps make informed decisions based on reliable data.

Timely Detection and Resolution: Reducing Financial Risks

The timely detection of errors through OnlineCheckWriter.com’s – Powered by Zil Money bank reconciliation is similar to an early warning system for potential financial risks. It enables quick action to rectify errors or report unauthorized activities to the financial institution. This proactive activity reduces the impact of any financial risks, safeguards users’ assets, and maintains the integrity of their financial standing.

Encouraging Financial Confidence: Empowering Financial Management

The increasing effect of a consistent bank reconciliation practice is the empowerment it gives to individuals in managing their finances. The confidence derived from knowing that their financial records line up with their bank’s statements promotes a sense of control and clarity, allowing for more strategic and informed financial decisions.

OnlineCheckWriter.com eases bank reconciliation by aggregating transaction data, allowing effortless alignment of personal records with bank statements. The platform optimizes the process, identifying errors efficiently. User-friendly tools enhance accuracy, minimize risks, and empower individuals to manage their finances confidently and precisely.