Business Virtual Cards for Total Control Privacy.com Alternative

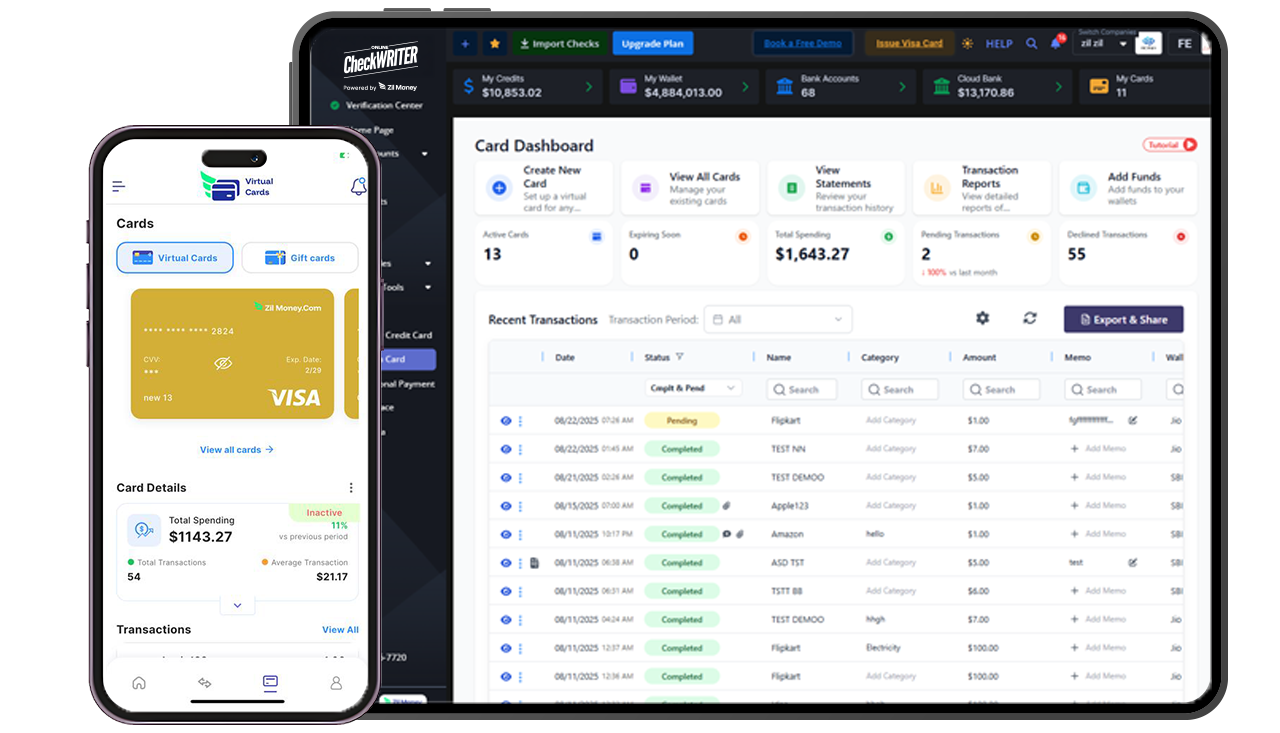

Create unlimited virtual and physical cards for employees, vendors, subscriptions, and business expenses—all from one centralized dashboard. Set precise spending limits, define usage rules, and track every transaction in real time without friction.

Overcome Daily Spending Friction

Many teams run into operational hurdles when they need more robust control over company spending. Stop struggling with the limitations of basic virtual card platforms.

Shared Card Confusion

Teams relying on basic platforms struggle with shared cards, creating operational bottlenecks and unclear ownership.

Lack of Visibility

Without granular controls, finance teams are left reconciling expenses in the dark, leading to month-end surprises.

Subscription Chaos

Managing SaaS subscriptions becomes chaotic without specific limits, hurting operational efficiency.

A Unified Solution for Total Spending Control

OnlineCheckWriter.com addresses your issues by offering a unified platform to manage all types of business spending. Every card comes with the ability to set precise spending limits, assign clear ownership, and define expiration dates.

Precise Limits

Set hard caps on merchant categories or total spend.

Clear Ownership

Assign every penny spent to a specific user or department.

Frictionless Workflow

Give your team what they need without losing control.

Vendor-Specific Virtual Cards

Perfect for SaaS subscriptions and online ads. Lock a card to a single merchant so it can’t be used anywhere else.

Physical Cards for Employees

Ideal for travel, meals, and supplies. Issue physical cards with pre-set budgets to keep in-person spending in check.

Gift Cards

Handle one-time use cases, employee rewards, or special promotions with easily generated gift cards.

Achieve Clear Accountability & Operational Clarity

By switching to OnlineCheckWriter.com, businesses gain practical outcomes that simplify financial operations. Finance teams spend less time on cleanup and more time on strategic oversight.

Accountability built-in for every transaction

Eliminate month-end surprises and guesswork

Real-time visibility into company-wide spending

Automated allocation according to your policies

Built for Confident, Control-First Teams

For users moving from the constraints of other platforms, we offer a renewed sense of confidence. Ensure your financial tools support your growth instead of holding you back.