Restaurant Employee Cards: Where Budgeting Meets Flexibility

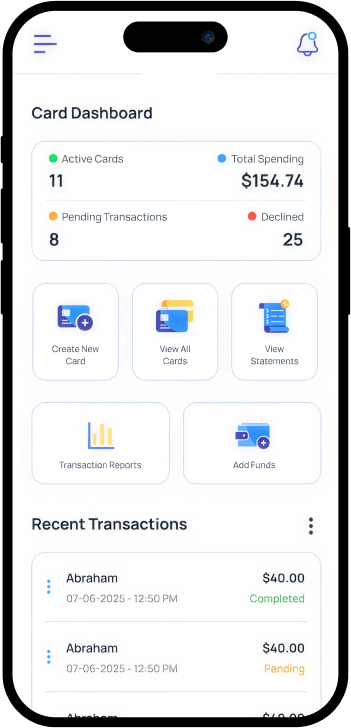

Make restaurant management easier with virtual employee cards that enable instant card creation and precise budget control. Set vendor-specific restrictions and track spending in real time across all departments. Simplify expense reporting with AI-powered receipt management and mobile payment solutions.

Why Choose Us

Expense Boundaries

Assign clear spending limits for food, equipment & vendor payments before card use.

AI Categorization

AI-powered receipt capture and categorization for easy expense reporting.

Safe Transactions

Each card has a unique number and can be frozen, replaced, or deleted instantly.

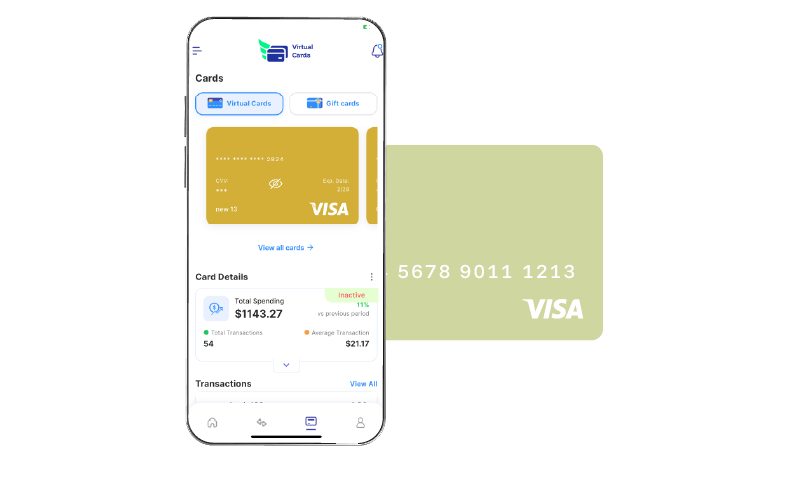

Centralized Oversight with Budget-Safe Virtual Cards

Issue vendor-specific virtual cards that carry preset limits and expire automatically. Keep spending aligned with operational cash flow using time-based caps. Multi-location restaurants can set geographic controls, ensuring each branch sticks to its budget.

Transparency and Trust in Every Business Payment

Every virtual card has its own 16-digit number, shielding your restaurant’s funds from misuse. Add to Apple Pay or Google Pay for instant tap-to-pay convenience. Automated alerts and AI-powered receipt capture turn purchases into organized reports effortlessly.

Get Restaurant Employee Card for your Valued Team

The End of Accidental Spending

Empower Your Business with Purpose-driven Financial Decisions

Emergency Response

Create instant virtual cards for emergency repairs or supply runs with elevated limits.

Staff Accountability

Assign cards to managers with role-based spending limits and merchant restrictions.

Merchant Restrictions

Block purchases from specific merchants or categories to align with company policies.

Inventory Control

Track food costs and purchases in real-time with automated categorization.

Wallet Integration

Add virtual cards to Apple Pay or Google Pay for secure, contactless payments.

Custom Card Boundaries

Control card accessibility by restricting locations and defining expiration periods.

Strategic Spending

The Smart Choice for Business Growth

Stop drowning in a sea of receipts and start managing your finances with precision. Virtual expense card centralizes all your payments, from daily food supplies to large equipment purchases. It gives you instant visibility into every dollar spent, helping you optimize your budget and make smarter business decisions effortlessly.