End Overspending with Subscription Payment Cards

Activate subscriptions fast with wallet-funded virtual Visa cards. Set budgets, lock vendors, and add time limits while AI handles receipts and reports with real-time, compliance-ready analytics.

OnlineCheckWriter.com- Powered by Zil Money is a financial technology company, not a bank. OnlineCheckWriter.com offers banking services through partnership with FDIC member banks Texas National Bank. Customers are not directly insured by the FDIC – but through the pass-through coverage of our partner banks and is conditional on proper titling, record-keeping, and custodial arrangements.

Safeguard Your Transactions

Maximum Protection and Authorized Control with Virtual Cards

Safe Spending Anytime

Push virtual cards to Apple Pay or Google Pay for secure, tokenized tap-to-pay transactions with biometric authentication.

Maximum Card Protection

Immediately create, freeze, or replace virtual cards, each with its own unique 16-digit number for maximum security.

Authorized Spending Control

Restrict card usage to specific countries, cities, or hours, ensuring payments only happen when and where you authorize them.

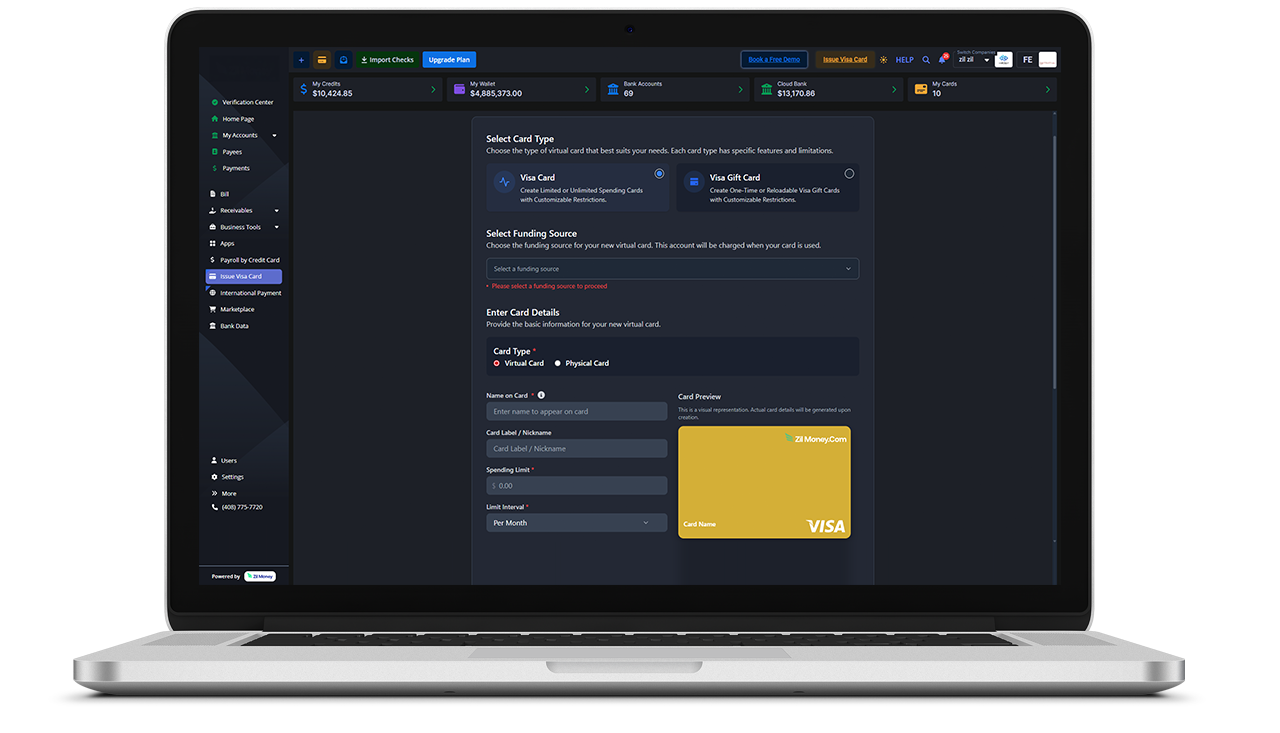

Stop Subscription Overspend

Lock Down Subscriptions and Centralize Oversight

- Stop surprise charges with vendor-specific cards that auto-expire and use preset limits (amount, time, place).

- See everything clearly with AI receipt scans and automatic reports—budgets stay on track.

- Keep control with roles, flexible approvals, instant renewals, and spend alerts.

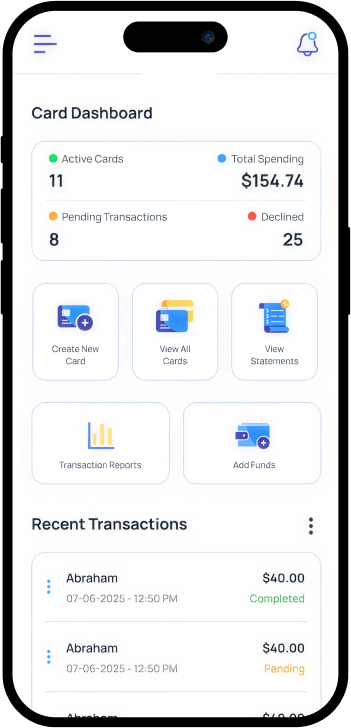

How It Works

Get Started in Three Simple Steps

Create Account

Sign up in minutes with just your email. No complex paperwork required.

Generate Cards

Create virtual cards instantly with custom limits and controls.

Start Using

Use cards for online purchases, subscriptions, and vendor payments with full security.

AI Expense Automation

Get Accurate Categorization, Clear Data, and Instant, Audit-Ready Spending Reports

Upload Reminders

Get SMS or app alerts after each purchase, reminding you to upload receipts without any delay.

Data Extraction

AI pulls date, amount, tax, and vendor from receipts automatically, so you avoid any manual typing.

Smart Sorting

Expenses are auto-sorted by vendor, category, and employee, giving you clean, organized data for reviews always.

Audit Insights

Expenses are auto-sorted by vendor, category, and employee, giving you clean, organized data for reviews always.

Trusted by Over 1 Million Businesses

Join growing companies that trust OnlineCheckWriter.com for secure virtual card solutions.

1M+

Active Business Accounts

100B+

Transaction Value Processed

15M+

Virtual Cards Generated

Ready to Get Started?

Join thousands of businesses already using our secure virtual cards for their online payments.

Frequently Asked Questions

Common questions about our cross-border business payment services and B2B platform