Vendor Payment Cards That Put You in Control

Take command of your vendor payments with a system that’s both powerful and simple. Instantly create virtual Visa cards for immediate use from your funded wallet. Set precise limits on when, where, and how much each card can be used, and lock or delete them at a moment’s notice. Plus, enjoy automated efficiency with receipt capture, AI-powered categorization, and real-time analytics that keep your business one step ahead.

How We Stand Out

Controlled Budgets

Control spending before it happens and keep every purchase policy-compliant.

Track by Vendor

Unique cards for each vendor make monitoring expenses clear and risk-free.

Wallet-Ready Payments

Push virtual cards into Apple Pay or Google Pay for secure, contactless payments.

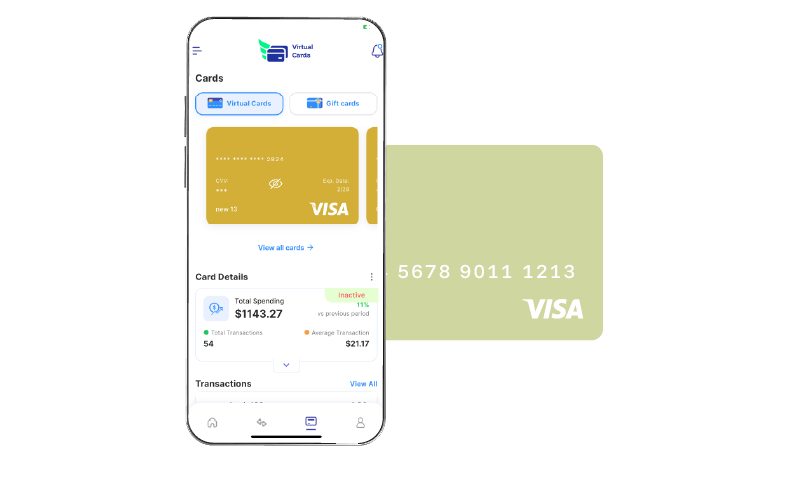

Keep Budgets Safe with Vendor-Specific Payment Cards

Lock down your vendor spending. Create a unique payment card for each of your vendors—from cloud services to suppliers— and block all unrelated merchants to keep your budget safe. You’ll gain complete control and visibility over every payment with powerful tools like per-transaction spending limits, customizable approval flows, and the ability to instantly freeze or replace cards.

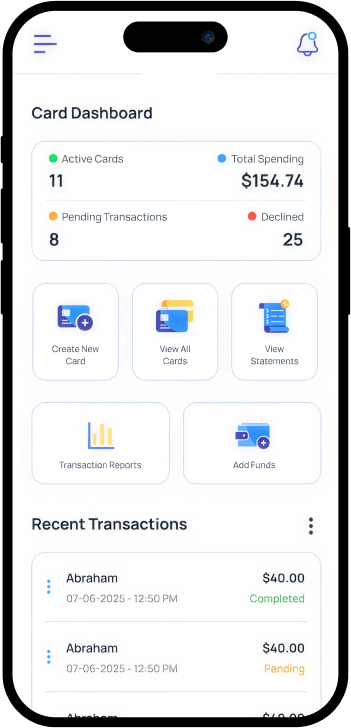

Convert Every Expense into Clear, Compliant Reports with Ease

Every swipe is recorded in real time, giving you full control to filter by vendor, category, item, or user. Automated notifications remind employees to upload receipts right away, while advanced AI organizes the data, itemizes every detail, and creates accurate reports so your financial records remain clear, compliant, and audit-ready.

Issue Vendor Payment Cards in Seconds

Spend Better, Grow Faster

Vendor Cards Made for Business Growth

Unique Card Numbers

Each vendor card has its own 16-digit number, simple to freeze, block, or cancel.

AI-Based Reports

Employees get instant SMS or app reminders to upload receipts after each transaction.

Clear Spending Visibility

Track company spending live with real-time, filterable reports for complete transparency.

Receipt Upload Alerts

Cards can be restricted by vendor, category, location, or specific times of purchase.

Restricted Spending Rules

Spending is automatically categorized and itemized into clear, accurate financial reports.

Empowered Team Access

Add team members with roles and permissions for secure, shared financial control.

Full Control, Every Time

Digital Upgrade for Your Vendor Payments

Virtual vendor payment cards give you the power to manage your business’s outgoing payments with precision. Issued instantly, these digital expense cards allow you to set specific spending limits and track transactions as they happen. By assigning each card to a single vendor, you ensure a secure and optimized process for all your financial transactions.