The challenge of processing vendor payments in the business world is more pressing than ever. Companies are often caught in a difficult trade-off: do you choose a payment system that is powerful and secure, but complex and difficult to use, or one that is simple and easy but lacks the necessary controls and security? This is the fundamental gap that modern virtual vendor payment cards are designed to bridge, offering a unique solution that is both incredibly powerful and remarkably simple.

Click Here For Interactive Demo ⬇

The False Choice: Power vs. Simplicity

Think about your current payment process. Are you constantly fighting fires, like over-budget purchases or fraudulent charges? Or are you so bogged down by a sluggish system that you can’t even get a clear picture of your spending in real time? This is the “false choice” that has plagued finance teams for years.

The “Powerful but Complex” Trap: These systems offer granular controls and reporting but are so complicated they become a burden. They require extensive training, and a simple action like creating a new card becomes a multi-step nightmare, leading to frustration and low adoption rates.

The “Simple but Limited” Trap: These tools are easy to use, but they lack the critical features needed for serious business management. They don’t offer vendor-specific controls, real-time analytics, or automated compliance checks, leaving your business exposed and reactive.

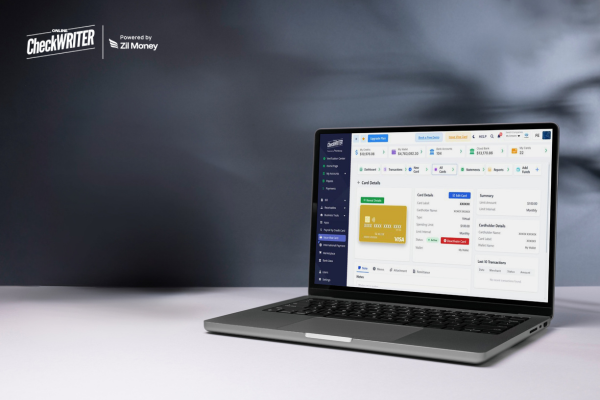

Virtual vendor payment cards from OnlineCheckWriter.com – Powered by Zil Money have shattered this paradigm. They are designed from the ground up to eliminate this trade-off, providing an elegant solution that is both robust and remarkably user-friendly.

Powerful Tools, Simple to Use

You can now create a unique payment card for every vendor, from cloud services to office supplies, instantly. With complete control over each transaction before it happens and automatic categorization and reconciliation of every expense.

This isn’t a far-off dream; it’s the reality of vendor payment cards from OnlineCheckWriter.com – Powered by Zil Money. Designed to bridge the gap, they provide a robust set of features within an intuitive, user-friendly interface.

Instant Card Creation: From Wallet to Vendor in Seconds

The first hurdle with any powerful tool is often the setup. Virtual cards eliminate this barrier entirely. With a funded digital wallet, you can generate a new, unique virtual Visa card in a matter of seconds. Need to pay for a new software subscription? Generate a card. A marketing agency invoice? Another card. This instantaneous creation process means you’re always ready for any business expense, without the wait or the hassle.

Granular Control for Every Transaction

This is where the true power of virtual cards shines. They allow you to control spending before it even happens. Each card is a mini-budget in itself, allowing you to set precise limits on:

When: Restrict purchases to specific dates or times.

Where: Lock the card to a single vendor or a specific category (e.g., “online software”).

How Much: Set per-transaction or total spending limits that cannot be exceeded.

A Smooth User Experience, Anytime, Anywhere

A powerful system is only useful if it’s accessible. Vendor payment cards from OnlineCheckWriter.com – Powered by Zil Money are designed with the user in mind. With a dedicated mobile app, you can create, control, and track your virtual cards from your smartphone, 24/7. You have complete control over your finances, wherever you are. Features like biometric security (fingerprint and face authentication) add an extra layer of protection, making the process not just easy, but also incredibly secure.

Stop sacrificing control for convenience, or vice versa. It’s time to embrace a solution that lets you spend better and grow faster. Virtual vendor cards are not just a new way to pay; they are a smarter way to manage your business, ensuring every dollar spent contributes directly to your bottom line.