Small business owners across the U.S. are no longer looking for just another payment method—they’re searching for freedom. Freedom to spend smartly, empower their teams, and keep their operations moving without interruptions. That freedom now lies in a single financial master key: the Virtual Card.

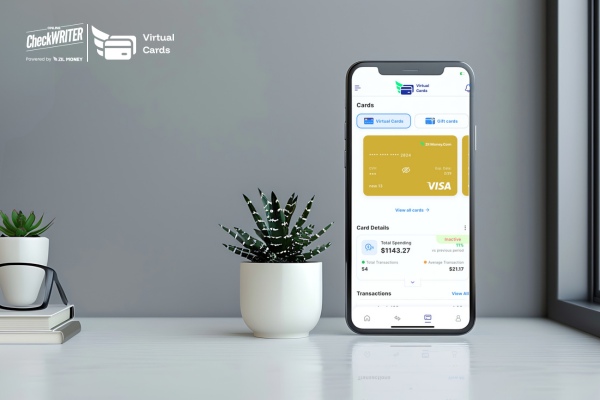

Today’s most agile SMBs are unlocking that key with a reliable, easy-to-use mobile app available on the Play Store and App Store. With a few taps, business owners can issue virtual cards, set spending boundaries, and keep finances flowing—all without paperwork or delays.

Click Here For Interactive Demo ⬇

Financial Freedom, Reinvented for SMBs

OnlineCheckWriter.com – Powered by Zil Money delivers that liberation through its advanced Virtual Card mobile app. Designed specifically for small businesses, the app blends flexibility and protection into one intuitive experience.

Instead of juggling spreadsheets or waiting for expense approvals, business owners can issue and manage multiple virtual cards from their phones—giving their teams financial independence while maintaining oversight.

Each feature inside the app acts as a key—unlocking new levels of control, clarity, and confidence in business spending.

The 4 Master Keys to SMB Growth with the Virtual Card App

1. Key to Empowered Spending = Smart Team Enablement

Empower teams, contractors, and vendors with digital cards that come with built-in boundaries. The app allows SMBs to issue cards instantly, customize usage settings, and define where, when, and how each card can be used.

How it unlocks growth:

- Assign cards to team members instantly from your phone.

- Set spending caps for projects or departments.

- Adjust permissions anytime through the mobile dashboard.

Freedom doesn’t mean losing control—it means controlling smarter.

2. Key to Instant Operations = Flexible Card Issuance

Business expenses shouldn’t pause because a physical card is delayed. The app lets you issue virtual cards instantly—ideal for freelancers, remote teams, or digital subscriptions.

How it unlocks growth:

- Create unlimited virtual cards in seconds.

- Assign one-time use cards for specific needs.

- Keep every transaction centralized in one account.

Why wait for growth when agility is already built into your pocket?

3. Key to Smarter Control = Proactive Expense Rules

The true strength of financial freedom lies in predictability. With the app, SMBs can set proactive limits based on time, amount, or vendor—ensuring budgets stay intact before any overspending occurs.

How it unlocks growth:

- Define usage hours or merchant categories.

- Limit spending by day, week, or project.

- Adjust rules instantly based on business needs.

Spending doesn’t have to be reactive—make it predictive.

4. Key to Total Security = Fraud Defense Built-In

Financial peace of mind starts with protection. Each card number generated within the app is unique, reducing exposure to unauthorized use. With PCI DSS and ISO/IEC 27001 certifications, end-to-end encryption, and multi-factor authentication, the app keeps every transaction secure.

How it unlocks growth:

- Instantly freeze or replace any card from your phone.

- Minimize fraud risks through single-use card options.

- Protect sensitive data from issuance to completion.

Confidence in security means confidence in scaling.

Why This Is the Essential Change for SMBs Today

The business world isn’t slowing down, and neither should financial control. Virtual Cards through the mobile app give small businesses the agility to act instantly, spend securely, and scale strategically.

3 reasons why change is urgent:

- Speed First

- Team Agility

- Expense Clarity

The Future Belongs to the Financially Agile

In 2025, financial agility isn’t optional—it’s the new foundation for growth. Those who adapt to smarter tools like mobile-based Virtual Cards aren’t just managing money better; they’re designing a future-proof business model.

From empowering remote teams to eliminating approval delays, SMBs that embrace this digital key are building systems that move at the speed of opportunity.

Unlock Your Growth Key Today

Your business deserves a financial tool that grows with it. The Virtual Card app from OnlineCheckWriter.com – Powered by Zil Money is available now on the Play Store and App Store—ready to give you the control, freedom, and security to scale smarter.

Install the app, create your virtual cards, and start unlocking the future of your business—one secure transaction at a time.