Granular Spend Controls That Actually Work

Set budgets, time restrictions, and transaction limits before cards are ever used. Your employees can spend confidently while staying within policy – because you control spending before it happens.

Smart Spending Rules

Configure spending rules based on amount, time, day, merchant category, specific merchants, geolocation, and custom approval limits – all from your mobile device.

Vendor-Specific Controls

Create vendor-specific cards with preset limits and auto-expiration. Assign cards to single vendors or block specific merchants and categories entirely.

Location and Time Intelligence

Limit card usage to specific countries, states, or cities. Restrict purchases to certain hours or days – perfect for contractor cards or employee lunch allowances.

Unique Card Numbers, Ultimate Security

Each virtual card gets its own 16-digit number and can be created, frozen, or deleted instantly. Unique numbers per merchant mean you can limit charges and freeze individual cards without affecting others.

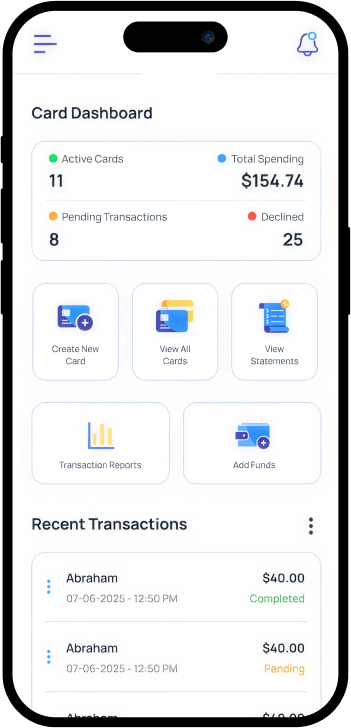

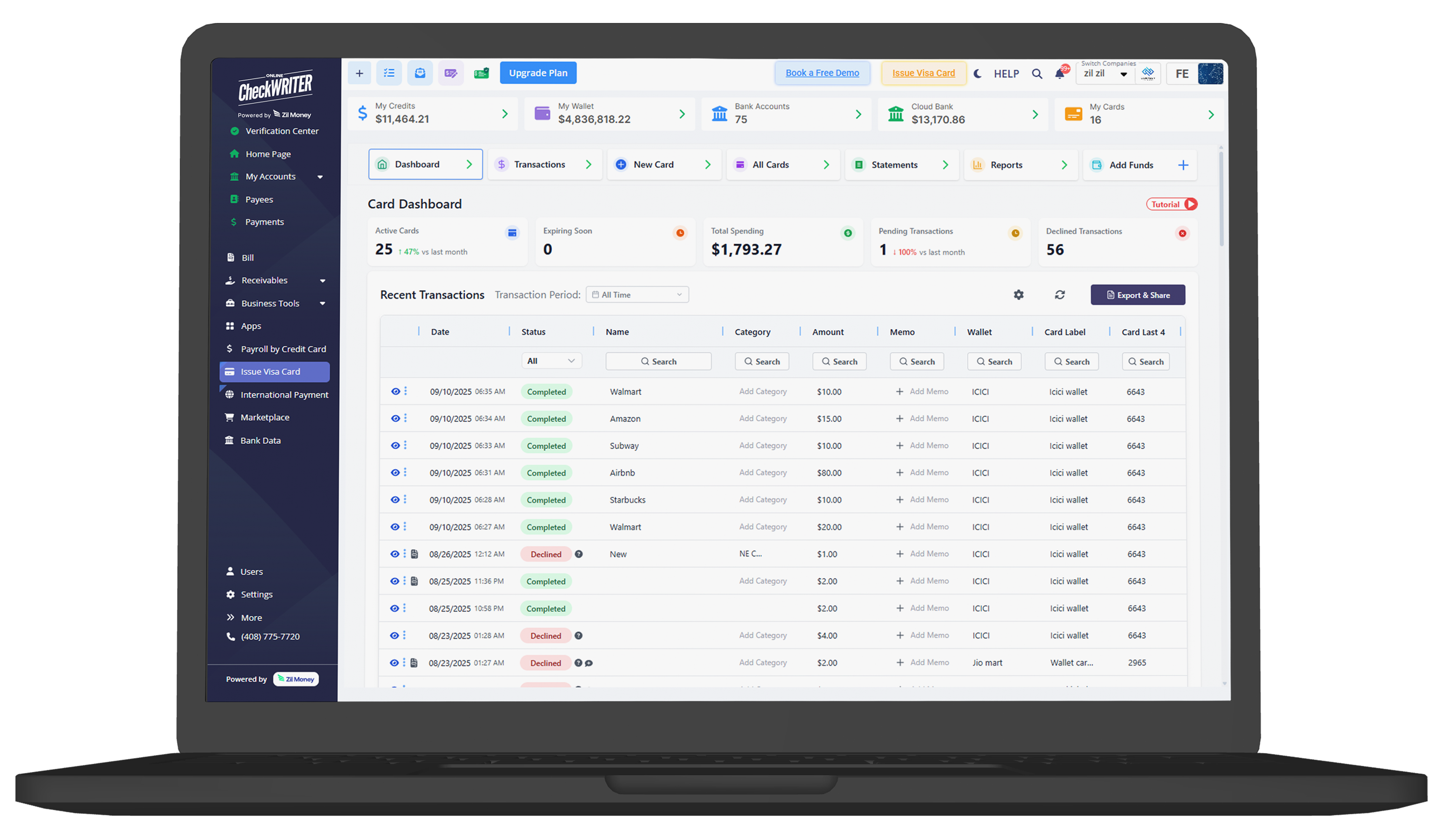

Instant card creation with multiple types available for different business needs

Immediate freeze, unfreeze, or replacement capabilities with one-tap mobile controls

Individual card management without disrupting your entire payment ecosystem

How It Works

Get Your Team Spending Smartly in Three Steps

Download our mobile app and connect your funded Zil wallet. No complex setup or lengthy approval processes required.

Issue virtual or physical Visa cards with custom limits, restrictions, and expiration dates. Set rules before cards are activated.

Your team starts spending within policy while you track everything in real-time. Automated receipt capture keeps records complete.

AI-Powered Receipt Capture and Insights

After every purchase, employees receive automated SMS or app notifications prompting receipt uploads. Our AI handles the rest, creating detailed expense reports automatically.

Smart Receipt Processing

Upload receipts via mobile camera and watch our AI extract vendor details, amounts, and categories automatically – no manual data entry required.

Intelligent Transaction Analysis

Our AI categorizes and itemizes transactions, creating comprehensive purchase reports based on extracted receipt data and spending patterns.

Automated Compliance Reporting

Generate detailed reports filtered by vendor, category, item, or user. Per-transaction limits and approval flows keep finance teams in complete control.

Real-Time Mobile Analytics

Track spending as it happens with mobile-optimized dashboards. Set up alerts and notifications for limit breaches or unusual activity.

Trusted by Modern Businesses Worldwide

Join thousands of companies using the Virtual Card mobile app to eliminate manual reimbursements, reduce fraud, and keep everyone on budget.

1M+

Users

$25B+

Mobile Transactions Processed

5M+

Virtual Cards Created on Mobile

Ready to Put Smart Spending in Your Pocket?

Download Virtual Cards mobile app and give your team the spending power they need with the controls you require.

Frequently Asked Questions

Download Virtual Cards mobile app and give your team the spending power they need with the controls you require.