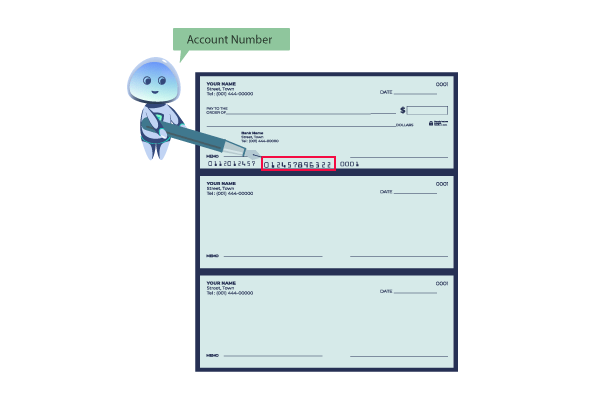

Usually, in order to set up electronic payments or direct deposits, you need your bank account number. The quickest way to locate that number is on a personal check, yet if you don’t have checks on hand there are alternative options. Your check’s account number can be seen there at the bottom of the check, there should be three sets of numbers in a particular computer-readable font:

- Your bank routing number is the first number on the left.

- Your account number is the second (middle) number.

- Your check number is the third number.

With OnlineCheckWriter.com – Powered by Zil Money, you can conveniently print checks whenever you need them, whether you’re at home, in the office, or anywhere with an internet connection and printer. Plus, you can easily include your account number on check. Our design tool allows for easy customization of checks, and you can even send digital checks via email or the ACH network.

Additional Figures on Your Check

When writing a check, it is essential to have not only your account number but also another number in order to make payments through check.

Routing Number

The numerical figure located on the leftmost side of the check is typically either the routing transit number (RTN) or American Bankers Association (ABA) number assigned to your financial institution. Comprised of a nine-digit sequence, this number serves to identify your bank, but it does not serve to identify your specific account within the bank.

Check Numbers

On the far right of the check, you will find a unique identifier comprised of a sequence of digits that constitute the check number. This number proves beneficial in the examination of individual checks for your personal accounting purposes and assists in monitoring your expenses and balancing your checkbook. It is important to note that the check number does not relate to your bank or account and is used solely as a personal reference. Moreover, the check number is not an essential element in payment processing as it can be reused or used out of sequence without significant implications.

Print Your Routing Number, Check Number, and Account Number on Your Checks using OnlineCheckWriter.com.

OnlineCheckWriter.com gives you the ability to quickly print checks on blank or standard paper whenever you need them, complete with the routing number, check number, and account number. Utilizing our design tool, you are able to personalize your checks and then transmit digital checks via either email or the ACH network. Utilize OnlineCheckWriter.com to make significant time and financial savings.

The Insecurity of Pre-Printed Checks and the Benefits of Using Blank Check Stock

The use of pre-printed checks is not a secure option as they can divulge sensitive bank information, such as routing numbers, account numbers, check numbers, and contact information. This can make them vulnerable to theft, with criminals potentially using the information to illegally access accounts and withdraw funds. Furthermore, for businesses, the cost of ordering and safely storing large quantities of pre-printed checks can be a challenging and costly endeavor.

In contrast, the use of blank check stock paper can be a more cost-effective and efficient alternative. By printing checks as needed, businesses can avoid the need to order and store large quantities of pre-printed checks. Moreover, the use of blank check stock allows for payment information to be added by specialized check printing software like OnlineCheckWriter.com rather than having the information pre-printed on the check. As blank paper carries no sensitive information, the use of this type of check stock is inherently safer.

Finding your bank account number on check is easy and essential for setting up electronic payments. OnlineCheckWriter.com allows you to print personalized checks with your routing, check, and account number on blank paper and send digital checks via email or ACH network. Using blank check stock is a safer and more cost-effective alternative to pre-printed checks as sensitive information is not printed on the check.