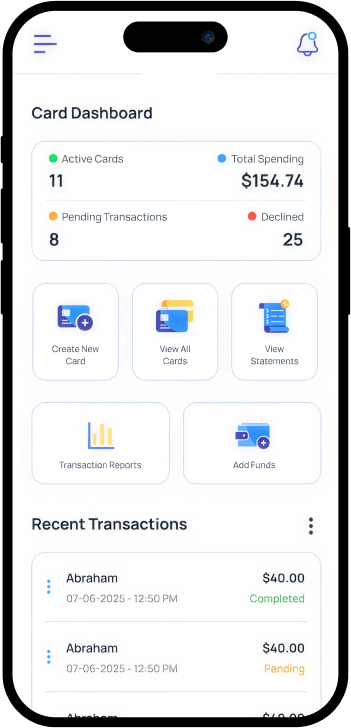

Get Your Instant Business Cards in Minutes!

You can instantly get different types of virtual business cards, control where and when they are used, and automate receipts and reports to make expense tracking easy.

What sets us apart

Instant Activation

Activate virtual visa cards in seconds for immediate access and secure payments.

Total Control

Customize card limits and track transactions with full control at your fingertips.

Expense Organization

Upload receipts and categorize expenses with AI-powered reports.

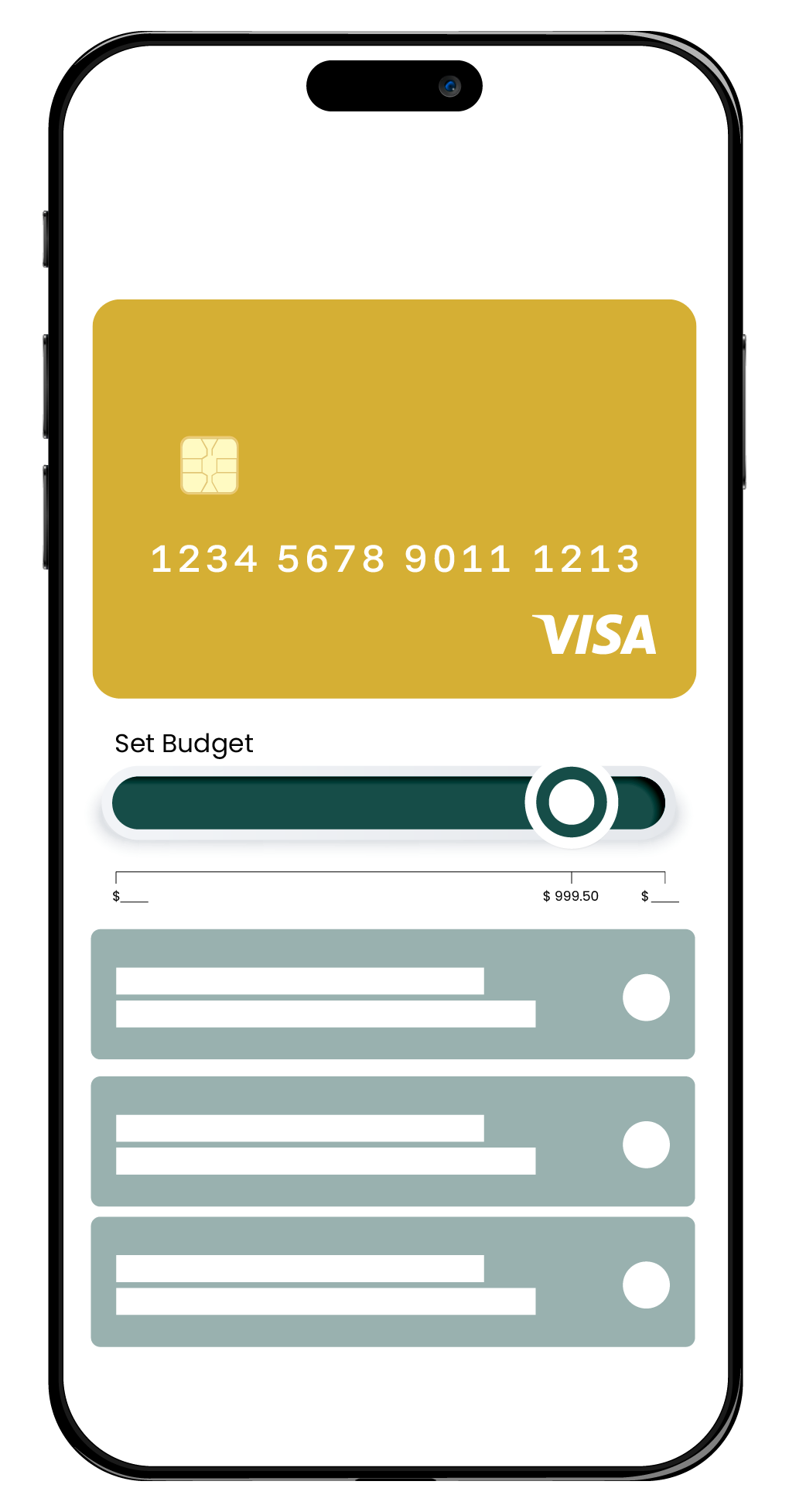

Cards That Work Within Your Budget

Provide your team with instant access to business cards, set personalized budgets, time limits, and location constraints, and ensure each transaction stays within your business policies. Spend smarter, not harder!

Instant Security with Every Swipe

Add your virtual card to Apple Pay or Google Pay for secure, contactless payments. Plus, instantly freeze or replace your card whenever needed, ensuring full control over your transactions.

Activate Virtual Visa Card Today!

Control First, Spend with Purpose

Empower Your Financial Decisions with Ease and Precision

Spend with Confidence

Set transaction limits and location rules to keep spending under control.

Smarter Financial Flexibility

Use virtual cards with mobile wallets for quick, secure, and contactless payment.

Freeze or Replace Cards Instantly

Lock cards instantly to protect your business from fraud and unauthorized charges.

Seamless Team Management

Give your team the tools they need to spend wisely while you stay in control.

Customizable Financial Solutions

Adjust spending limits, transaction types, and even card access based on your needs.

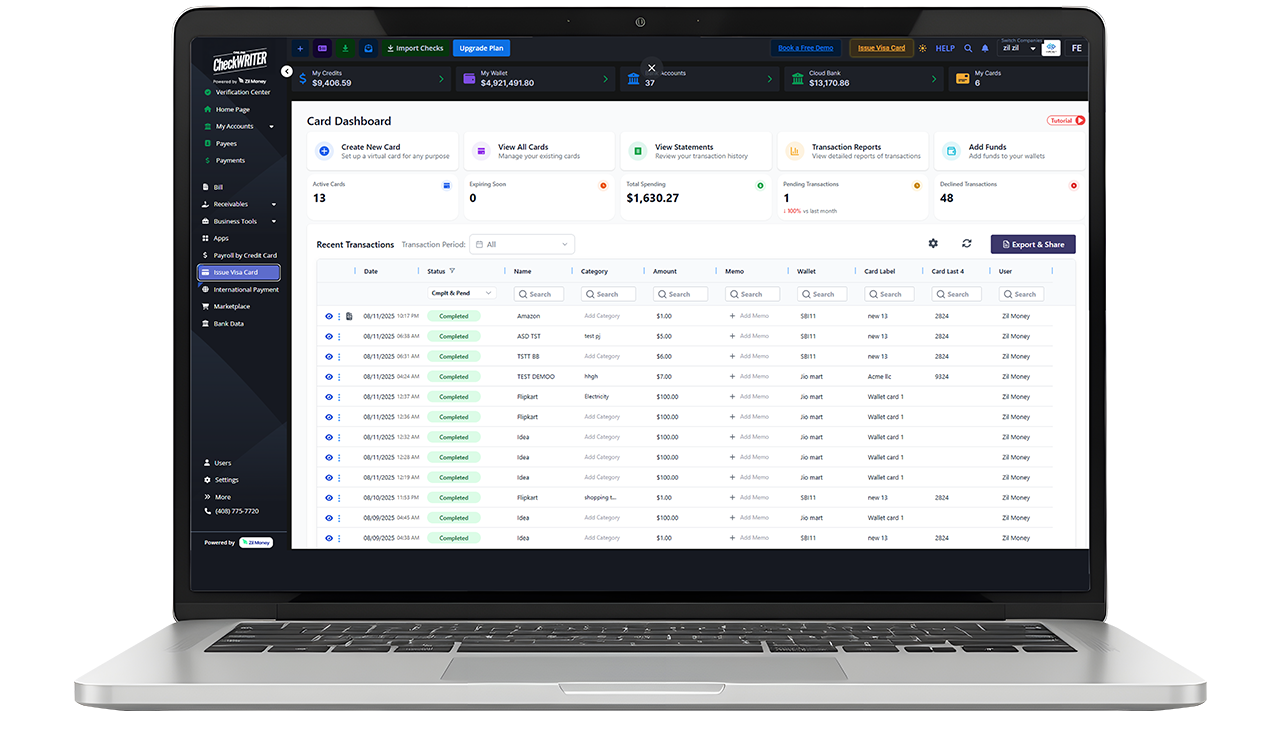

AI-Powered Expense Insights

Track and analyze your spending with powerful, automated reports.

ABOUT US

Get To Know More About The Platform

OnlineCheckWriter.com – Powered by Zil Money is the ultimate B2B payment platform, offering powerful solutions for businesses. Simplify your accounts payable with virtual cards, international payments, and payroll by credit card. Optimize operations with ACH, wire transfers, and check printing. Get to know OnlinCheckWriter.com – Powered by Zil Money and take control of your business finances today.