Bank checks have become integral to the financial system, serving as a reliable payment method for various transactions. However, it is essential to understand the different parts of a check to ensure that transactions will execute successfully.

One of the most critical elements of a check is the account number, which is vital for identifying and verifying the account holder’s information. Print account number in check and all other information from the comfort of your home or office with OnlineCheckWriter.com – Powered by Zil Money.

What is a Bank Check?

A bank check is a written document issued by a bank that allows the account holder to make a payment to a specific payee. It is an effective means of payment, commonly used for transactions such as rent payments, utility bills, and other financial obligations.

Checks come in different types, including personal checks, cashier’s checks, and traveler’s checks, and the information required may vary slightly depending on the type of check.

However, all checks have similar parts, which include the payee’s name, the amount of money to be paid, the signature of the account holder, and the account number. All this information can be printed error-free with OnlineCheckWriter.com.

Parts of a Check

To clearly understand the significance of the account number, it is essential to have a general overview of the different parts of a bank check. These parts include the following:

1. Payee: The name of the person or company that will receive the payment.

2. Amount: The money to pay in numbers and words.

3. Date: The date when the check is written.

4. Memo line: A brief description of the reason for the payment.

5. Signature: The signature of the account holder.

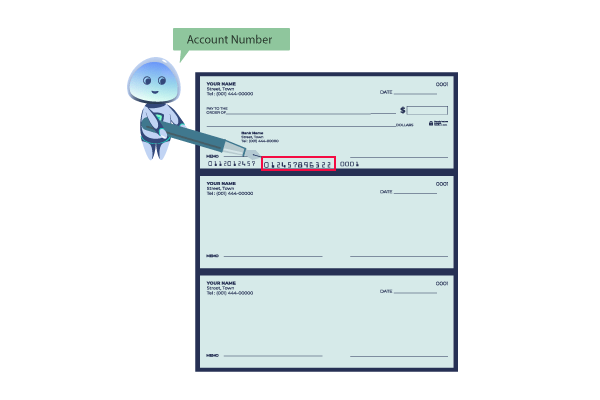

6. Account number: The unique number assigned to the account holder’s bank account.

7. Routing number: A nine-digit number used to identify the bank that issued the check.

With the drag-and-drop tools from OnlineCheckWriter.com, anyone can print unlimited checks quickly and securely.

Account Number in Check

The account number is one of the most critical elements of a bank check. It is a unique number assigned to an account holder by the bank and serves as the account’s identifier.

The account number contains essential information about the account, such as the account holder’s name, the account type, and other identifying details. The account number is necessary to verify the account holder’s information and ensure the payment is credited to the correct account.

How to Print Account Number ?

Printing the account number correctly is crucial to ensuring successful financial transactions. To print the account number, it is essential to follow the bank’s guidelines for formatting and placement. Typically, the account number is printed at the bottom of the check, next to the routing number.

In addition, the account number should be printed in a clear and legible font to avoid any errors or confusion. It is also essential to double-check the account number to ensure it is correct and matches the account holder’s information. Finally,Print the account number error-free by following all bank guidelines with the help of OnlineCheckWriter.com.

Account Number vs. Routing Number

The account and routing numbers are both essential components of a bank check, but they serve different purposes.

The routing number is a nine-digit number used to identify the bank that issued the check. The routing number is essential to ensure the payment is credited to the correct bank and account.

On the other hand, the account number is a unique number assigned to the account holder by the bank and serves as the account’s identifier. The account number contains essential information about the account, such as the account holder’s name, the account type, and other identifying details. The account and routing numbers are necessary for successful financial transactions.

Conclusion

In conclusion, the account number is vital to a bank check, and its significance must be emphasized. It serves as the account holder’s bank account identifier and ensures the payment is accurately credited to the correct account.

Failure to correctly fill in the account number in a check may result in late payment penalties, fees, and inconvenience for both the payer and the payee.

To avoid these issues, it is crucial to take the necessary steps to ensure the accuracy of the account number on a check. OnlineCheckWriter.com is the ideal option to print checks error-free from the comfort of home or office.