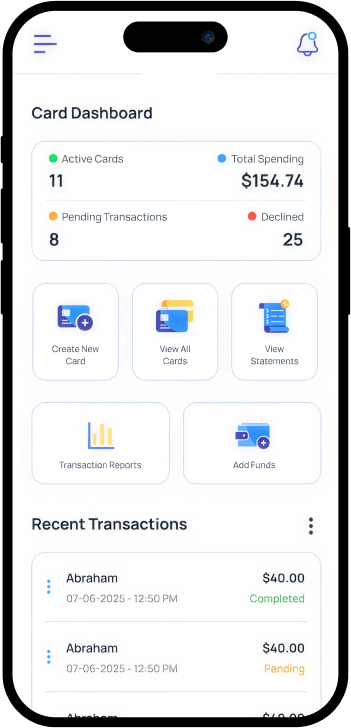

Virtual Business Expense Cards

Quickly create virtual expense cards for your employees, complete with fraud protection, unique card numbers, and the ability to instantly freeze or reissue cards. Easily add them to mobile wallets for secure, contactless transactions.

What sets us apart

Limitless Control

Set daily, weekly, or per-transaction limits and stay in full control of your spending.

Digital Wallet Ready

Push virtual business expense cards to Apple Pay or Google Pay for contactless payments.

Easy Management

Manage all your virtual cards effortlessly and securely from one easy-to-use platform.

Empowering Teams with Digital Expense Cards

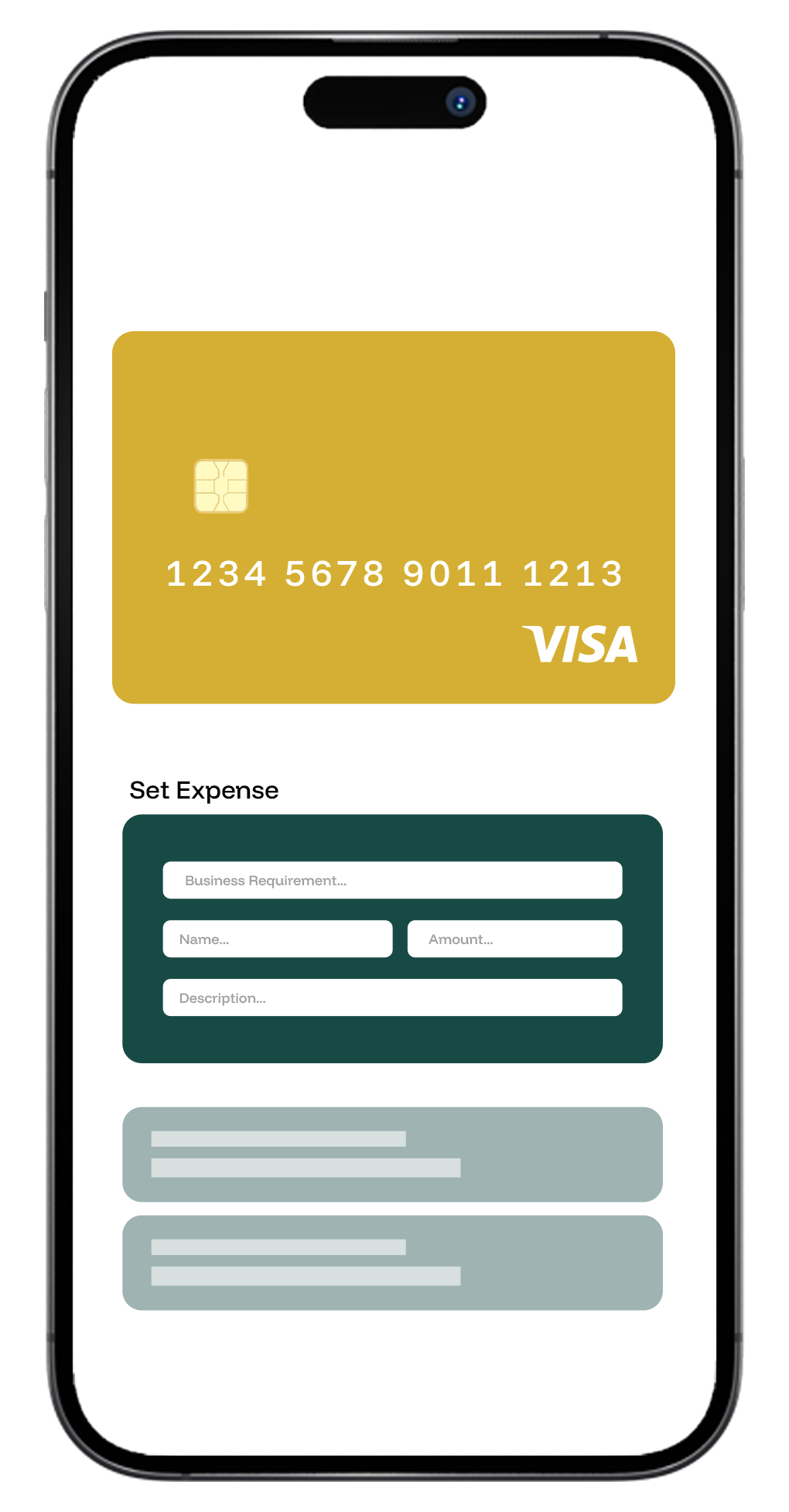

Create virtual cards in seconds for any team member or business requirement, so you can stay agile as your business needs evolve.

Take Control Before Spending Happens

Take control with customizable limits, merchant restrictions, and time-based rules. Virtual business expense cards protect your budget while empowering your team.

Complete Business Control

Secure Payments, Unified Platform, and More

Quick Setup

Set up and manage your cards in minutes, no hassle.

Smooth Payments

Make secure, contactless payments directly from your phone.

Built-in Protection

Keep your data secure with encryption and freeze options.

Contactless Convenience

Make payments securely with your mobile wallet.

Organized Finance

Streamline your financial data and stay in control.

Unified Platform

Integrate payments, invoicing, and expense tracking in one place.

Smarter Payments with Virtual Card

Safeguard your business with unique virtual card numbers for each vendor and instant card freezing or replacement for unparalleled fraud protection.

ABOUT US

Get To Know More About The Platform

OnlineCheckWriter.com – Powered by Zil Money, is a comprehensive B2B payment platform designed to streamline business finances. The platform provides powerful, all-in-one solutions to simplify accounts payable and optimize operations. It offers a variety of tools, including virtual cards, international payments, and payroll by credit card, alongside essential functions like ACH, wire transfers, and check printing. Take control of business finances today with OnlineCheckWriter.com – Powered by Zil Money.