Trust is the foundation of every strong business relationship. For small business owners in the U.S., ensuring vendors and workers are paid on time is more than just a transaction—it’s about reliability, respect, and long-term growth. Late payments create frustration, strain partnerships, and slow down momentum. This is where the Virtual Card becomes a game-changer, giving instant relief and peace of mind.

But why does a virtual card app matter so much today? Because it bridges the gap between business obligations and business trust, providing immediate access to funds and control. With the right app in hand, small business owners don’t just pay faster—they run their businesses smarter.

Click Here For Interactive Demo ⬇

How the Right Virtual Card Brings Peace of Mind

- Instant setup: Issue cards in seconds to vendors, contractors, or team members.

- Built-in security: Every card has protections that shield sensitive data.

- Full control: Owners define the rules—spending limits, expiration dates, or vendor-specific usage.

Why The App Feels Different = Convenience Meets Confidence

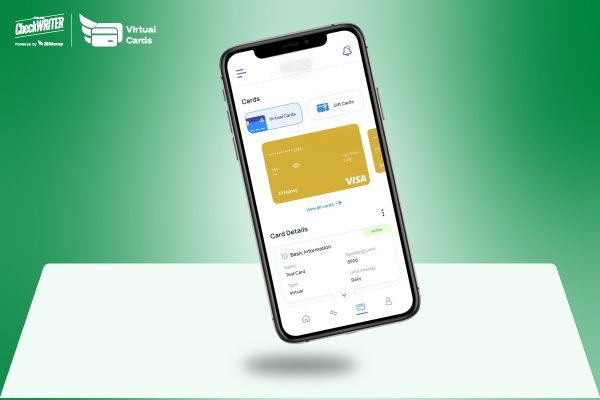

That’s where OnlineCheckWriter.com – Powered by Zil Money steps in. Already trusted for simplifying financial operations, the platform has taken a leap forward by introducing a dedicated mobile app for virtual cards—available on both the Play Store and the App Store.

For small business owners, the app means no more delays, no more confusion, and no more worrying about overspending. Everything happens within seconds, right from a smartphone.

Now, let’s explore the features that make the app stand out.

1. Instant & Flexible Cards = Freedom at Your Fingertips

Through the mobile app, business owners can issue virtual cards instantly—whether for employees handling day-to-day operations, contractors managing projects, or subscriptions tied to digital tools. Instead of waiting for traditional processes, a card can be created and used immediately, giving businesses the agility they need.

2. Proactive Spending Limits vs Endless Overspending

Expense chaos happens when limits aren’t clear. With the app, owners set budgets upfront—time-based, vendor-specific, location-based, or per-transaction. That means no surprise charges and no post-expense headaches. Everything is controlled before a card is ever used.

3. Advanced Security = Fraud Risks Reduced

Every card issued through the app comes with a unique number. If one vendor card is compromised, it doesn’t affect the rest. Add to that the ability to freeze or replace a card instantly, and the protection becomes even stronger. The platform’s PCI DSS and ISO/IEC 27001 certifications ensure that every transaction is encrypted and compliant with top standards.

4. Centralized Management = Simplicity for Growing Teams

Running multiple cards for employees or contractors doesn’t have to feel complicated. The app consolidates everything under one account. Owners can issue cards, apply restrictions, and monitor usage with clarity. For example:

- A contractor card restricted to a single store.

- A subscription card that only works within a set budget.

- A vendor card is tied to specific business hours.

This keeps spending predictable and operations organized.

5. One-and-Done Cards = Zero Data Exposure

Sometimes, security means making sure a card is used only once. The app allows the creation of single-use virtual cards that expire right after the transaction. This feature is perfect for high-risk scenarios or one-off purchases—removing the risk of data being reused.

The Bigger Picture: Why Virtual Cards Define 2025

What separates the leaders from the laggards in 2025? It’s not just better products—it’s better financial systems. Small business owners who adopt virtual cards gain:

- Speed in paying vendors without delay.

- Trust from partners who receive funds on time.

- Control over every transaction from their phone.

Ask yourself:

- Would your vendors feel more confident if they were paid immediately?

- How much stress would disappear if you could manage spending rules in advance?

- Could you grow faster if payments were no longer a bottleneck?

Virtual cards are no longer a luxury—they’re a competitive advantage.

Take the Next Step

The question is not whether you should adopt this, but when. With the Virtual Card app available now on both the Play Store and the App Store, small business owners can move from stress to clarity in just a few taps.

Payments don’t need to feel heavy anymore. Relief, trust, and control are already in your pocket.