A promissory note is a written promise to pay a specific amount of money to someone at a particular time, or “on demand.” Promissory notes are standard when borrowing money from a bank or financing a big purchase, but they also for personal finance scenarios such as loaning someone else money. A promissory note sets out the loan terms, including the loan amount, interest rates, and when payments are due. A written promissory note is more comfortable to enforce in court than a verbal agreement.

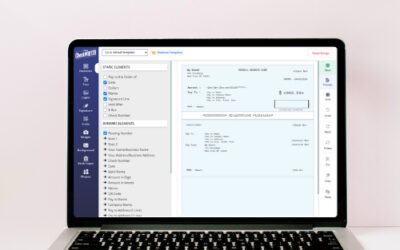

Online Check Writer

Key figures

1M

Users

4,000+

New Customers a Week

50,000+

Transactions per Week

Common Uses for Promissory Notes

Promissory notes use for mortgages, car loans, credit lines, home equity loans, loans to small businesses and entrepreneurs, student loans, and personal loans. Promissory notes also can be used for loans to family or friends. It may seem awkward to ask your brother or best friend to sign a legal document, but a promissory note protects both you and your relationship. It clarifies your expectations and shows that you are serious about being paid back.

What to Include in a Promissory Note

A promissory note lays out all the terms of the loan. It’s much more than a simple, “I owe you $1,000.” A promissory note should include:

- The names and addresses of the lender and the borrower

- The amount of money being loan The interest rate

- The collateral or “security” use, if any

- The amount of the payments and when they are due

- Penalties for late payments, including late fees and repossessing the collateral

- The signatures of the borrower and the lender

It is to make sure you include all the necessary information and the right legal language; it’s helpful to use a promissory note template.

Negotiating a Promissory Note

If you are lending someone money, a promissory note helps protect your investment and gives you some recourse if the borrower doesn’t pay. One of the first issues to consider is whether the message will be secured or unsecured. A fast note uses real estate or personal property as collateral. If the borrower doesn’t pay, you can take the property. An unsecured note relies on the borrower’s promise to pay. If the borrower doesn’t pay you, your only recourse is to go to court. Secured notes are typical for purchases of large assets such as houses, cars or boats, or loans involving large amounts of money. Unsecured notes are more common for smaller amounts. Because unsecured loans are riskier for the lender, they often carry a higher interest rate.

How good is the borrower’s credit?

A credit check will show whether a borrower pays their bills on time. Based on the credit check, you can decide not to loan someone money to require a cosigner or to negotiate a higher interest rate or steeper penalties for nonpayment.

Should the loan be amortized or repaid in a lump sum?

An amortized loan pay in installments of principal and interest over some time. A lump-sum loan is repaid all at once. Amortization is typical for large loans, while lump sum repayments work well for small amounts or situations where the borrower has only a short-term need. As the lender, you aim to protect yourself and limit your risks.

What to Do If You’re Pay Late (or Not at All)?

Ideally, your borrower will make payments on time, but that doesn’t always happen. If your borrower misses a payment, the first thing to do is send a bill or email reminding them that the payment is late. Often that’s all you need to do. If borrowers still don’t pay, try talking to them. Sometimes borrowers will pay if prompted personally, or you may find out why they are late with their payment. It can give you a chance to negotiate a way to get paid, including waiving late fees or accepting partial payment in exchange for getting paid quickly. If the loan is secured, you can proceed with taking the property that serves as collateral for the loan. If the loan is unsecured and the borrower still does not pay, you can send the debt to a collection agency. The collection agency will take over the debt collection process for you and will charge a percentage of the amount collected as a fee. If all else fails, you can take your borrower to court. A promissory note puts the terms of a loan in writing, minimizing the chance of any misunderstanding between you and the people you loan money to. And, if your borrower doesn’t pay, the promissory note can help you pursue available legal remedies. With the help of OnlineCheckWriter.com – Powered by Zil Money you can print and send checks easily.