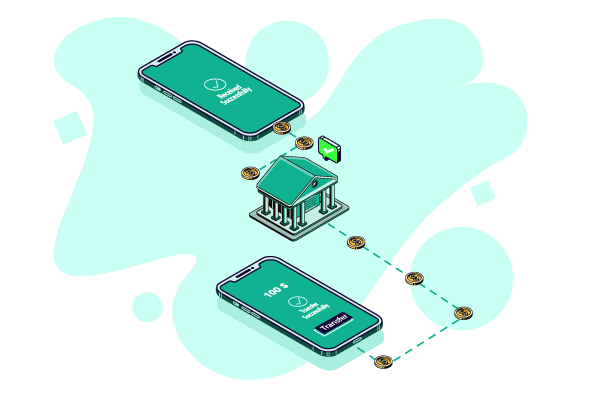

The emergence of fintech platforms is transforming the financial landscape. These platforms are redefining traditional banking methods, offering innovative solutions for fast, efficient, and secure financial transactions. The Automated Clearing House (ACH) transfer is a prominent feature in this digital shift, which facilitates electronic money movements between banks within and outside the United States. The fintech industry plays a major role in the ACH transfer bank.

Understanding ACH Transfer Bank

ACH transfers, a pivotal component in electronic payments, simplify transactions by allowing direct deposit and withdrawal of funds between banks. Businesses and individuals seeking a safe and inexpensive payment processing solution must prioritize this. To guarantee the safety and consistency of all US financial transactions, it is operated by the National Automated Clearing House Association (NACHA).

Global Reach of ACH Transactions

The reach of ACH transfers extends beyond the US borders, connecting global banking networks. This feature is particularly beneficial for businesses engaged in international trade, enabling them to manage cross-border transactions efficiently. The versatility of ACH in handling various currencies and conforming to international banking regulations makes it a preferred choice for global financial dealings.

A Prime Platform for ACH Transfers

For entrepreneurs seeking a robust platform for ACH transfer bank services, OnlineCheckWriter.com – Powered by Zil Money emerges as a top contender. By combining dependability, security, and simplicity, this platform accommodates the varied requirements of contemporary businesses. Business proprietors seeking to optimize their financial processes favor it due to its comprehensive feature set and simple interface.

Comprehensive Features of OnlineCheckWriter.com

Besides ACH transfer services, the all-in-one platform provides various features, including check printing, expense tracking, and cloud-based check management. Because of its adaptability, users can effortlessly manage different facets of their finances under one roof, positioning it as a comprehensive financial tool.

Conclusion

Fintech companies such as OnlineCheckWriter.com are transforming the way we manage financial transactions in a time when efficiency and speed are critical. The incorporation of ACH transfer bank services within these platforms offers a testament to the evolving nature of financial management, blending technology with traditional banking practices. As these platforms continue to evolve, they stand as pillars of innovation, ushering in a new age of financial efficiency and connectivity.