In the dynamic landscape of small business operations, tools like check draft can be pivotal. Similar to electronic checks, these drafts offer an accelerated and secure means of transaction, promoting efficiency and reliability for businesses. Understanding the importance of check drafts and their utilization is key to optimizing financial processes.

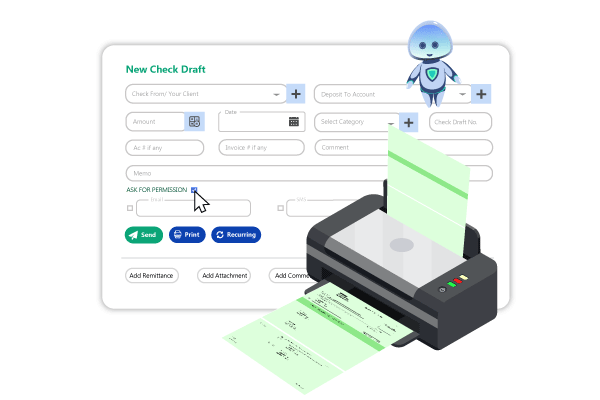

Instant Check Creation through Online Software

Obtaining payer authorization via phone or online platforms initiates the check draft process quickly. With online software, businesses gain the flexibility to create checks properly, eliminating the delays associated with traditional methods. This instantaneous generation allows for timely payments and smoother financial transactions, easing a more active business operation.

Eliminating Signature Requirements for Deposits

A distinctive advantage of bank drafts is the elimination of payer signature requirements. Businesses can print bank drafts without needing payer signatures, quickening the deposit process. This advanced approach enhances operational efficiency by cutting administrative steps and reducing turnaround times for cash flow.

Efficiency in Recurring Payments

Recurring bank drafts emerge as a boon for businesses handling regular payments. This system allows businesses to collect payments from their payers regularly, ensuring timely and consistent inflow without gathering overdue amounts. This consistency promotes financial stability and predictability for small businesses.

Enhanced Security and Reliability

Check drafts operate within secure online platforms, ensuring a high level of data encryption and protection. This protected security gives businesses the confidence to conduct financial transactions without the fear of data breaches or unauthorized access. This reliability promotes trust between businesses and their clients.

Savings in Time and Resources

Using OnlineCheckWriter.com’s – Powered by Zil Money check drafts significantly reduces the time and resources expended in traditional payment methods. Printing bank drafts eliminates the need for manual signatures and physical bank visits for deposits. Such savings in time and resources empower businesses to focus on core operations, driving growth and innovation.

Optimizing Financial Operations

OnlineCheckWriter.com’s check draft service empowers businesses by enabling quick check creation and secure transactions. With user-friendly online software, it eases the check drafting process, omitting payer signatures for faster deposits. It’s a reliable solution for recurring payments, ensuring efficiency and financial stability for small businesses.

Check drafts are a beacon for small businesses aiming to optimize financial operations. Their fast creation, signature requirement elimination, recurring payment ease, and strong security features collectively empower businesses to operate efficiently. Embracing the potential of check drafts unlocks opportunities for enhanced productivity, reliability, and financial stability, moving small businesses toward sustained success in an ever-evolving market landscape.