Bank Draft & Check Printing | Customize and Print Checks

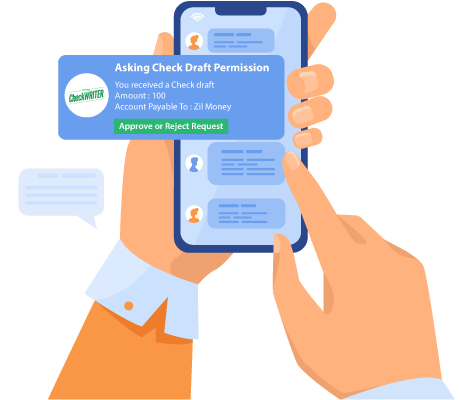

Bank Draft, also known as remote checks or check drafts. You can create them with the cloud-based check printing platform by obtaining permission from the account holder and his or her bank details. As a result, you can receive one-time or recurring payments with low transaction and gateway fees using this platform. Moreover, printing checks on blank paper at your office desk can save you 80% on check printing costs.

Additionally, the platform offers Pay and Get paid by ACH, Direct Deposit, RTP, eChecks, printable checks, and $1.25 check mailing.

OnlineCheckWriter.com- Powered by Zil Money is a financial technology company, not a bank. OnlineCheckWriter.com offers banking services through partnership with FDIC member banks Texas National Bank. Customers are not directly insured by the FDIC - but through the pass-through coverage of our partner banks and is conditional on proper titling, record-keeping, and custodial arrangements.

Learn More About Bank Draft

See The Interactive Demo ⬇

TRUSTED BY MILLION PLUS USERS

Bank Draft Definition

Bank draft, also called demand draft or check draft, is drawn by a vendor and approved by the payer or account holder. A regular check is written by a bank account holder and signed. With the account holder’s approval, the vendor or merchant can make a check draft without a signature. Moreover, it can be used as a payment method, just like check. Check drafts are guaranteed by the issuing bank, unlike checks. Check drafts provide the payee with a secure form of payment.

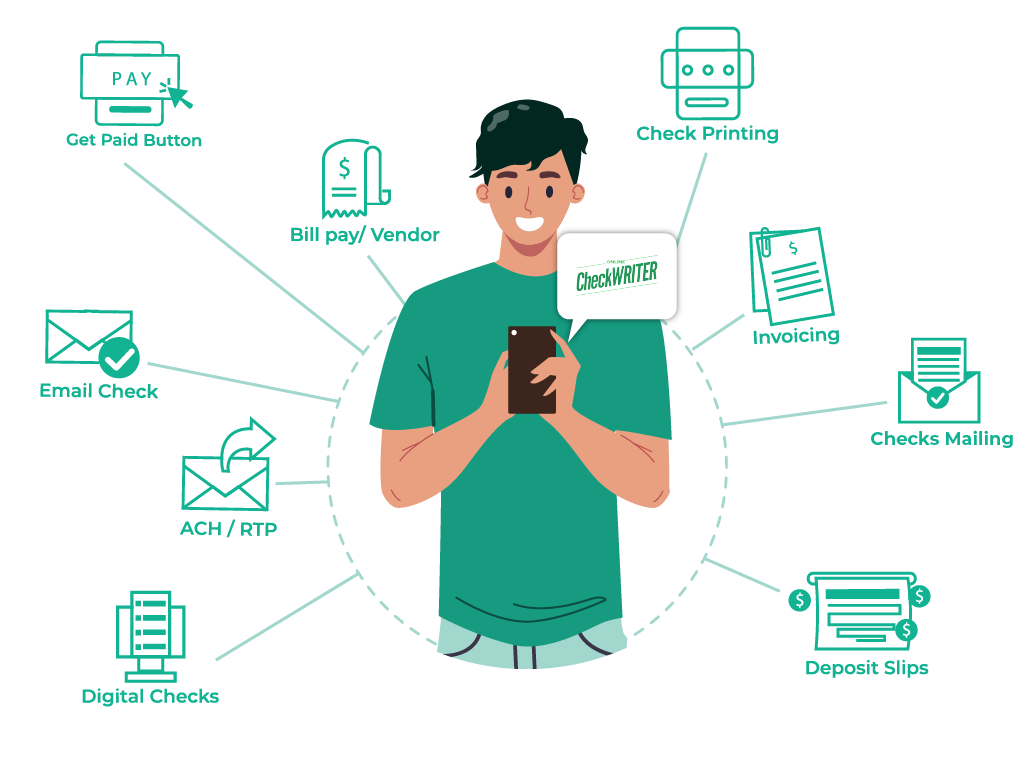

Our Features AP/AR

OnlineCheckWriter.com - Powered by Zil Money offers a wide range of payment features to make your business transactions secure and flexible. Now you can pay and receive payments with the easy-to-use software and dive into the journey.

Check Printing

Create and print business checks at your office desk with a drag and drop design.

ACH

Pay or get paid one-time or recurring ACH/RTP with low transaction fees.

Integration

Integrate with the top third-party applications.

Pay Bill

Pay Bills Online, Schedule them, Manage suppliers, and reduce risk.

Payments by Credit Card

Now pay by credit card even if they don't accept them.

Wire Transfer

Transfer money electronically from one financial institution to other.

Deposit Slips

Instantly create & print the deposit slip of any Bank. Keep track & auto reconcile it.

Invoicing

Create invoice to your customer and send link through email.

Cloud Bank

Open an online checking account with no hidden charges.

Email Check

Send your checks as a one-time printable pdf with a tracking facility.

Payment Link

Create an HTML form or link to receive payments.

User/Approver

Give access to accountant or clients with a role based user and approval process.

Overnight Check Mailing

Overnight Check mailing without leaving your desk. We print and mail it by FedEx.

Digital Checks

Digitize your paper checks and make your payments via email or text.

Bank Data

Connect & reconcile, Categorize from Any Financial Institution automatically.

API/White Label

Interactive developer-friendly API. Complete white label solution.

Bank Draft by Phone

Accept your client’s check draft over the phone, no need to wait for the check to arrive in the mail. You will need to enter your client’s information into the software, including the bank routing number and account number. In the next step, you print the check on behalf of them with their authorization by any printer. You can deposit this check draft to the bank just like a regular check. It comes without a signature and states, ‘No signature required and approved by the depositor.’ Deposit this check draft to the bank like a regular check. You can do it for a one-time payment or recurring payments. Also, you are open to various payments according to the agreement you have with your clients.

Send your client a link to their phone or email and have them fill out the bank information and sign it.

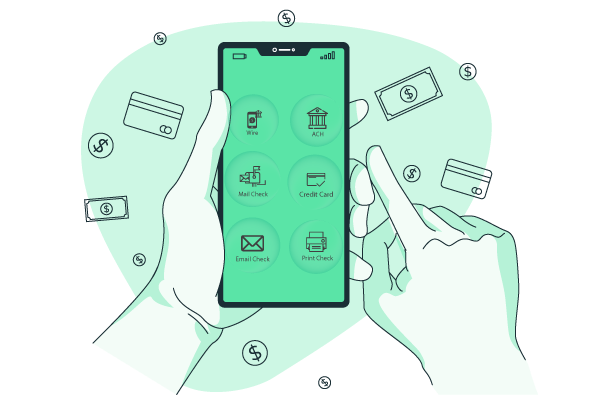

All-In-One Mobile App

Handling ACH payments, Wire transfers, or RTP with OnlineCheckWriter.com is easy and safe. The all-in-one platform lets you make checks and eChecks to send and receive money. There are low transaction fees. All of the web features and functions are available in the app, which makes it easy to get started. In this way, you can still run your business on the go.

MULTIPLE FEATURES, ONE PLATFORM

CONNECT ANY BANK, PREVENT FORGERIES

OPEN A MODERN CHECKING ACCOUNT WITH ZIL US

Pay And Get Paid Easily

Customers can pay you easily through OnlineCheckWriter.com. You can email or SMS payment links to make things go quickly. Customers can pay right away through the link, or if they already have an account, the bill takes them directly to the page where they can pay with a check or direct deposit. You can accept payments in the form of checks, cards, ACH, and RTP, all of which are accepted at face value. This makes it easy and flexible to pay your bills.

FREQUENTLY ASKED QUESTIONS

Can a bank draft be cashed by anyone?

A bank draft can be cashed by anyone if the payer authorized. OnlineCheckWriter.com offers check draft processing.

Is bank draft safe?

A bank draft is safe because it is an official check that banks print and guarantee. It is safer than personal checks. Additionally, they are much easier and are a more convenient method for transferring large sums of money. OnlineCheckWriter.com offers check draft processing.

How do I get a bank draft?

Your bank will withdraw money from your account and transfer it to a specified account in the bank's name. The issued document is made out in the name of the person who will receive the money. Get a bank draft using OnlineCheckWriter.com.

Bank Draft vs Check

A bank draft is a secure payment method used for high-value transactions and is issued by the bank. A check is a relatively unsecure payment method commonly used for every day issued by the payor.Get a bank draft using OnlineCheckWriter.com.