Pay With eCheck

Pay With eCheck via the check printing software for efficient transactions. Send and receive funds electronically, reducing processing time. eChecks can be sent to vendors, customers or employees through email or text. This digital payment option offers more security to businesses and reduces the risk of check fraud. Also send ACH, wire transfers and mail checks through the platform.

OnlineCheckWriter.com- Powered by Zil Money is a fintech, not a bank. FDIC coverage is provided through our partner banks Texas National Bank and Lincoln Savings Bank.

Click Here For Interactive Demo ⬇

TRUSTED BY MILLION PLUS USERS

Pay With eCheck Or Print Checks

OnlineCheckWriter.com – powered by Zil Money simplifies business payments with eChecks and printed checks. Users have the option to print checks on blank stock paper with any printer or send them via email as one-time printable PDF eChecks. This flexibility allows businesses to efficiently handle their finances and meet the demands of payees.

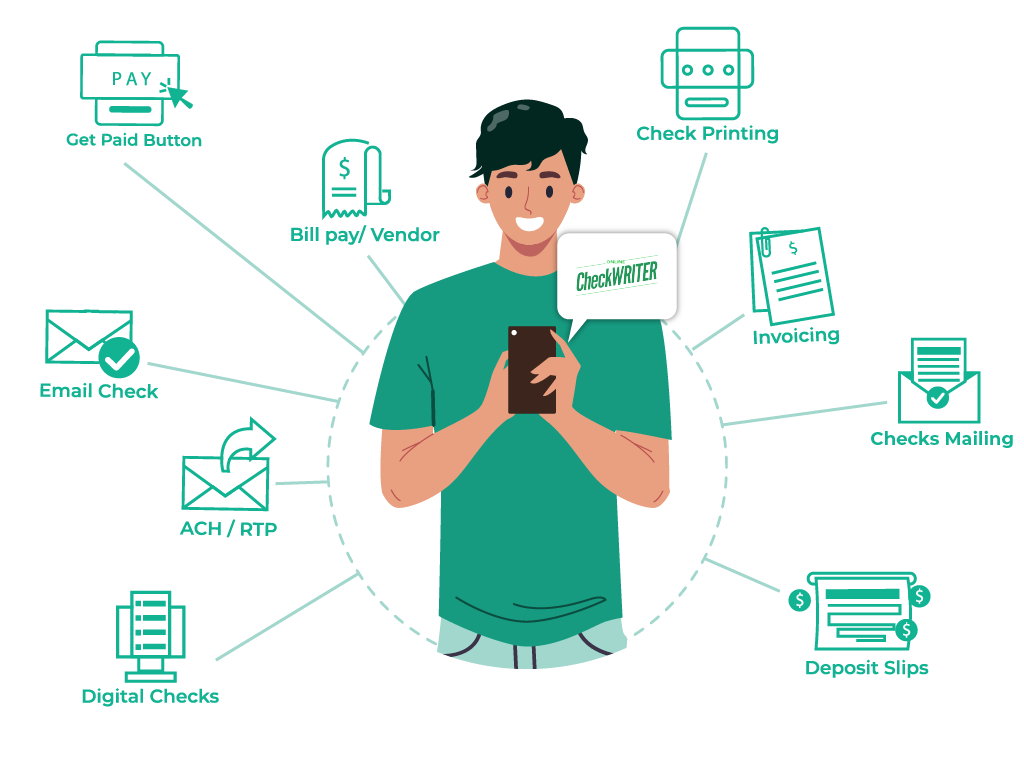

MULTIPLE FEATURES, ONE PLATFORM

CONNECT ANY BANK, PREVENT FORGERIES

OPEN A MODERN CHECKING ACCOUNT WITH ZIL US

How To Pay With eCheck

After signing into OnlineCheckWriter.com – powered by Zil Money and creating your checks, you can go to the “Payments” section and select the checks you would like to send. After clicking on the “Send” button, you can choose the “Email” option. Add a message to the Payee or attach files to the check before choosing the “Send Email” option.

Easy To Access

Instant Access To Your Account Anywhere, Anytime.

High Security

Secured With Encryption, Fraud Detection, and Infrastructure.

Easy Payment

Efficiently Transfer Funds To Where They're Needed.

What Is eCheck Payment?

eCheck or electronic check is the digital version of paper checks which can be used to pay monthly bills, rent or mortgages. OnlineCheckWriter.com – powered by Zil Money supports eCheck payment and the feature is available at affordable costs. Both payers and receivers can benefit from the convenience of eChecks as they are cost-effective and clear quicker.

Pay With eCheck: Streamline Your Finances Anytime

You can access the check printing software at any time from any device. Send and receive payments from your office or on the go. Handle all financial tasks easily with multiple payment options like ACH, wire transfers, payment links, and RTP. Simplify bill payment and manage your cash flow efficiently with the solutions offered by OnlineCheckWriter.com – powered by Zil Money.

FREQUENTLY ASKED QUESTIONS

How do eChecks work?

eCheck processing happens through the ACH network and money is moved from the payer’s account to the payee's account electronically after authorization. OnlineCheckWriter.com - powered by Zil Money, allows users to send and receive payments via eChecks, printable checks and mail checks easily.

Are eChecks safe?

eChecks are a secure form of payment because they have measures like encryption in place to prevent fraud. OnlineCheckWriter.com - powered by Zil Money is a secure platform that lets users transfer money using eChecks, printable checks, and checks by mail.

How to deposit eCheck?

You can deposit eChecks into your bank account using mobile payment apps or your online payment platform by taking clear photos of both sides of the check and submitting them for verification. OnlineCheckWriter.com - powered by Zil Money, enables you to handle bill payments and other transactions through eChecks easily.

eCheck vs ACH

eChecks, electronic versions of paper checks, allow individuals to initiate bank account transactions digitally, while ACH (Automated Clearing House) facilitates electronic payments via the ACH network. With OnlineCheckWriter.com - powered by Zil Money, you can send and receive payments using printable checks, eChecks, mail checks, ACH, etc.

REVIEWS FROM ESTEEMED CUSTOMERS

Here are some precious reviews from G2 – Business Software Reviews. We are pledged to make your life simple with all our features.

$100B+

Gross Transaction Volume so far

Revolution

In payments processed through Zil Money.

18M+

Checks Processed

Partnership

Our platform works with over 6000+ banks and financial institutions around the world.

1M+

Business User Accounts

Integrity

Trusted by more than 60,000+ customers within 10 months of launching.