One of the most widely used payment methods in the US is ACH. ACH transactions are an essential component of the daily operations of any business. People and businesses use online transactions for many different purposes. ACH is simple to use, manage and less expensive than card networks, ACH payments enable direct electronic fund transfers from bank to bank. In addition to ACH, OnlineCheckWriter.com – Powered by Zil Money offers many other features, including sending and receiving payments via wire transfer, check drafts, and check-by-mail services. Low transaction costs are involved in doing this.

What is an ACH?

The Automated Clearing House (ACH) financial network is used for electronic payments and money transfers in the United States. When money is transferred between banks using the Automated Clearing House network, it is done through ACH bank transfers, which NACHA manages. Paying for things online is possible with ACH transfers. Most people use them for automatic bill payments or direct deposit.

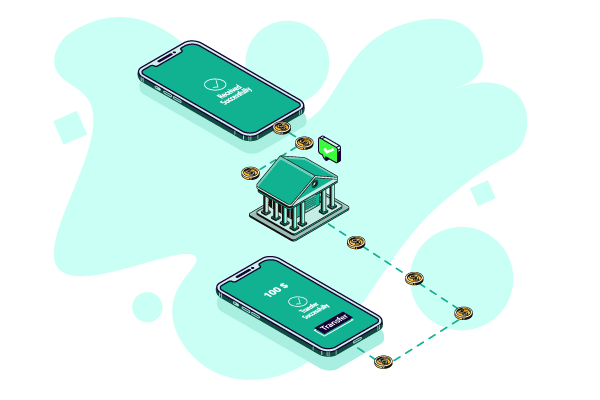

How does ACH payment work?

- Setup

Verify that you have permission to withdraw funds from your customer’s bank account before proceeding with the transaction. By signing a bank authorization form, your consumer can provide their consent.

- Initiation

As the Originator, you begin by submitting your bank, often known as the ODFI, data files on the transaction (Originating Depository Financial Institution). These files contain information about the bank account, routing numbers, and transaction type (debit or credit).

- Batching

Your ODFI gathers all transaction files delivered to them and sends them regularly to an ACH operator, either Fed ACH (the Automated Clearing House of the Federal Reserve Banks) or the Electronic Payments Network (EPN).

- Distribution

The RDFI, also known as your customer’s bank, receives the data files from the ACH operator (Receiving Depository Financial Institution).

- Completion

The money is then taken from your customer’s bank account by the RDFI. When you receive your payment, the transaction will be considered successful.

Advantages of ACH

- Convenience

- Easier recurring billing

- Preferred funding compared to checks

- Fewer disputes

- More secure

- Environmentally friendly

Disadvantages of ACH

- Slow process

- Limitation on the transfer amount

- Cutoff times

- Lack of International payments

Types of ACH Transaction

The ACH network is composed of two distinct types of transactions:

- ACH credits

- ACH debits

ACH Debits

An ACH debit takes the money out of the account being paid. This means that the person receiving the money (the payee) initiates the payment. ACH debit is a pull transfer.

The common type businesses uses are:

- Recurring customer fees or charges

- Mortgage payments

- Payments on car

ACH Credits

The phrase ACH credit describes the transaction in which money is moved from one account to another, usually an originating account. ACH credit is a type of push transfer.

- Pay bills.

- Collect income.

- Direct deposit.

- Purchasing goods online.

How OnlinecheckWriter.com can assist you?

ACH payments involve two people. One person pays, and the other person gets paid. The first person is called the initiator, and the second is called the receiver.

- With OnlineCheckWriter.com, the initiator can make a transaction from anywhere, anytime.

- The initiator will be asked to provide checking account details, such as the recipient’s routing and bank account numbers.

- The receiver’s bank information and transaction amount can be found in the ACH files, along with many other parameters and formats.

- The receiver’s bank debits the amount from the initiator account.

- The receiver’s account gets credited.

Other benefits include instant money transfers using wire transfers, managing your payroll, creating and managing invoices for your business, designing, customizing, and printing checks instantly on-demand, managing all your bank accounts in one platform, and many other features.

Some ACH transactions are denied, why?

A penalty fee may be assessed to your company if an ACH payment is declined. To prevent paying additional monthly fees, attempt to fix the issue as soon as possible. You might only accept ACH payments from dependable clients to minimize this inconvenience.

Penalty fee for rejected ACH transaction

- R01- Insufficient funds: This implies the customer did not have sufficient money in their report to cover the quantity of the debit entry.

- R02 -Bank account closed: This happens when a customer had an account with your company, but they closed it.

- R03-No bank account or unable to locate the account: This code is used if the data you entered (either your name or account number) does not match the bank’s records.

- R29- Rejected: If a bank rejects your request to take money from someone’s account, you will get this rejection code.

ACH Transfer vs Wire Transfer

Wire transfers are limited to pushing money, which is the fundamental distinction between ACH and wire transfers. ACH can push and pull money, thus, it can obtain funds from other sources. Money transactions of millions of dollars can be made via wire transfer. It typically credits more quickly than ACH. In comparison to ACH, wire transfers typically have higher transaction fees. Pick the appropriate payment option for your company transaction and cash flow requirements.

Start using OnlineCheckWriter.com and use features like ACH, wire, and many others and see how easily your business finance will change for the better. With our easy-to-use platform, you can transfer money and print checks. You can also use our platform to pay bills, payroll, and many other features.