In business finances, credit memos from the bank play a vital role. Understanding their significance is essential for companies to manage their cash flow effectively. These documents mean more than just reduced owed amounts; they considerably influence financial operations.

Understanding Credit Memos

Credit memos from the bank are documents sellers issue to buyers, indicating a reduction in the amount owed. They are important in rectifying billing errors, addressing returned goods, or granting discounts. Essentially, they ensure accurate accounting by adjusting the accounts receivable and payable. This simple document holds the power to maintain financial accuracy and promote healthy buyer-seller relationships.

Financial Accuracy and Transparency

Among the web of financial transactions, maintaining accuracy is important. Credit memos play a significant role in ensuring financial records accurately reflect transactions. These documents enhance transparency by rectifying errors or adjustments, enabling companies to present accurate financial statements to stakeholders, and promoting trust and credibility.

Impact on Cash Flow

Efficient cash flow management is the lifeblood of any business. Credit memos directly impact this flow by adjusting the amounts owed and received. These adjustments can influence cash availability, affecting day-to-day operations, investments, and strategic decisions. Companies must understand and use credit memos wisely to maintain a healthy cash flow.

Building Strong Business Relationships

Beyond their financial implications, credit memos contribute to nurturing strong business relationships. Timely and accurately issued credit memos reflect professionalism and commitment to rectifying errors or accommodating buyer needs. This fosters goodwill and enhances the likelihood of future collaborations and loyalty from clients and partners.

Maximizing the Impact

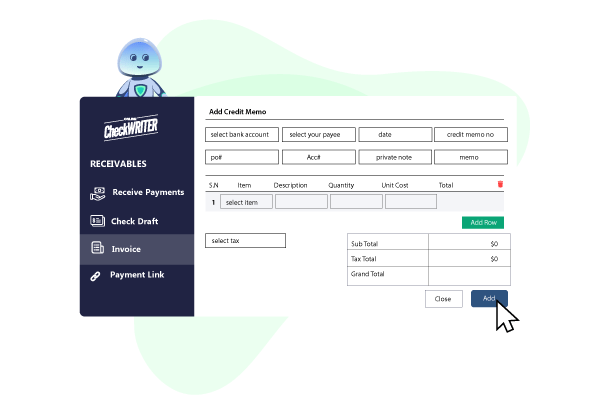

Using the full potential of credit memos involves strategic implementation. Proper documentation and categorization of credit memos help in tracking financial adjustments accurately. Using dedicated software or systems optimizes this process, ensuring proper distribution and tracking of credit memos.

Moreover, active communication with clients regarding credit memos strengthens relationships. Clear explanations about adjustments showcase professionalism and transparency. Timely resolution of complexities or refunds through credit memos cultivates trust and improves the company’s reliability.

Conclusion:

Credit memos are vital documents in the wide landscape of business finances, ensuring accuracy, transparency, and healthy financial operations. Understanding their role extends beyond monetary adjustments, impacting relationships and the overall financial health of a company. Mastering their usage is important for any flourishing enterprise.

Regular review and analysis of credit memo trends provide insights into repetitive issues or areas needing attention. This active approach helps refine business processes and minimize errors, optimizing financial operations for sustained growth and stability.