Mailing checks was once the most efficient and effective way to transfer money. Although it seems checks are no longer used by many today, the numbers show a different story. Billions of dollars are still transferred via check every year, and according to the most recent Federal Reserve figures, 14.5 billion checks worth $25.8 trillion were used in recent years. So, even though these traditional methods of payment transactions may appear less popular than their faster, ultra-modern electronic counterparts, they aren’t obsolete yet. With the advent of advanced platforms like OnlineCheckWriter.com – Powered by Zil Money, mailing your checks through postal services has become relatively easy and safe.

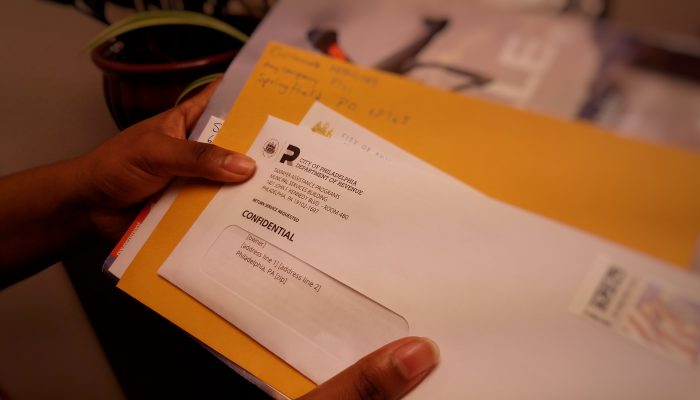

It would be best to keep in mind that while mailing a check seems safe; paper checks run the risk of being lost or stolen. In simple words, there are a lot of risks involved in sending a check through the mail. However, Online Check Writer will help you overcome all the risks and let you send checks via mail safely.

Gone are the days of long processing times, hidden charges, and tiring verification processes. With Online Check Writer, you can easily send checks via mail service, and the advanced security measures mean you can mail checks without any hindrance.

Click Here For Interactive Demo ⬇

Online Check Writer

Key figures

1M+

online business accounts

88B+

transaction volume

16M+

checks processed

Is Writing a Check Really Necessary?

If you are planning to send a check through postal mail, it’s a good idea to be a little extra careful. Although it’s relatively rare nowadays, some businesses and agencies still prefer to use paper checks rather than accepting cash. And, even though there are other alternatives available like eCheck, Bank transfers, and Electronic transfer services such as Paypal or Venmo, the practice of using paper checks is not entirely outdated just yet.

So, what happens if your mailed check gets stolen?

Risks of Sending a Check Through the Mail

There are many reasons why sending checks through the mail is not as popular as many other transaction methods today. And these reasons are why you need to take necessary precautions before sending your check.

- Checks stolen run the risk of identity theft and can be used to transfer funds from your account to another account. Your sensitive bank account information in the wrong hands means serious trouble for your personal and professional life.

- Anyone who has possession of your check also has your account number, the bank’s identity, and your signature. Thereby, check mailing also poses the risk of counterfeit checks and forged signatures.

- In addition, checks must reach the recipients on time. However, sending checks through the mail can be a time-consuming task, and the more time it takes for a check to be delivered, the more the chances of fraud.

How to Mail a Check Safely

Checks may no longer be the popular or best way to conduct transactions, but millions still commonly use them. If you are like the millions, then at some point, you will probably need to send off a check in the mail too. Before writing a paper check and turning it over to the U.S. Postal Service, you can take some steps to safeguard the mailing process.

- Conceal the check

- Fill out the check properly

- Consider adding tracking

- Avoid extra details

- Never send money

- Consider making the check restricted

- Drop the mail at a secure location

- Hide the check

or

- Use Online Services

Get Started Right Now with OCW

These days, there are several alternative methods available to transfer money. You can use the Check By Mail service offered by Online Check Writer to send a check via mail safely and quickly. This way, it’s guaranteed that the check will arrive safely and that the recipient will get their money quickly. Typically, regular mail takes a couple of days to reach the destination. But the $1 Check By Mail service, including postage and paper charge, will print your check, label it, envelop it and post it on the same business day, making it cost-effective and time-saving.

Online Check Writer can help you send your checks via mail. It can help you in every step of the check mailing process and assure you that your checks will be delivered to your clients efficiently on time. The checks are mailed with the necessary bank account information and your business details and sent off through USPS or FedEx to whoever the payee is. It’s just like you mailing the checks yourself!

Since the platform can integrate with more than 22,000 financial institutions, you don’t have to worry about the check printing process. The platform can easily import data from QuickBooks, Zoho, Gustu, Zapier, etc., and use the information to print checks instantaneously. Moreover, Online Check Writer makes sure that all your checks are in line with the USPS regulations.

So, the question that remains is, “can I send a check via mail safely?” The answer is 100% yes. And, Online Check Writer is here to help you in every step of the process. Skip the hassle and update your payment method with modern security and payment technology.