Do Americans usually write checks for less than a dollar? The answer is yes. A significant number of people depend on check writing, and the amount on them varies from less than a dollar to some highest figures.

Click Here For Interactive Demo ⬇

The steps involved while writing a check of less than one dollar are:

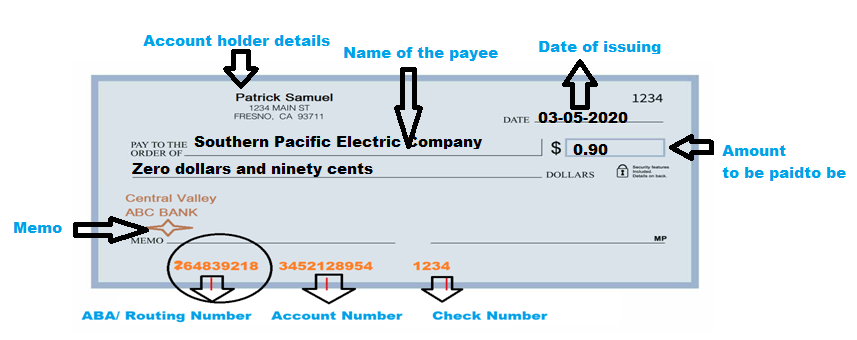

- Fill up the date: The initial step is to fill out the date on the check. The date means the date on which the check is issued. If it is a post-dated check with a much bigger amount, you have to inform your bank and the payee. Any mistakes that happen regarding the date will make the bank confused. This will result in the rejection of the check.

- The payee name: On the space provided, write the name of the payee without any errors. Write the payee name on the line titled “pay to the order of”. You have to write the payee’s full name then you should not use abbreviations. For example, while you write the Southern Pacific Electric Company check, write the full name. Mere writing SPEC will not work. However, if the payee permits you to register, you can write the abbreviated name.

- The amount in numeric: Write the amount of the check in digits in the dollar box provided. If the check amount is less than one dollar and 90 cents, place a decimal point in front of the number and write “.90”. The dollar sign will be there on checks outside the box, and there is no need to put the dollar sign again.

- The amount in words: On the following line, write the number of checks in words. Suppose it is 90 cents, then it should be written as “zero dollars and 90 cents”. Apart from this, cross out the ‘dollar ’sign printed next to this line.

- Signature: Put the sign on the signature line. There is a probability that the banks cross-check the account holder’s signature with that in bank files. However, for a smaller amount of less than one dollar, the probability is negligible.

- Memo details: The details on the memo line are optional as the bank does not need them. It is for the understanding of the account holder as a small description of why the payment is made, which will help in future accounting.

Other banking details that should be there on the check are the account number, bank routing number, and check number. All these details will be there on pre-printed checks, and OnlineCheckWriter.com – Powered by Zil Money helps you save the check template for recurring payments. While you save the check template, by default, all these banking details, such as account number and routing number will be there, and the user has to fill out only the other details. After filling up all these details, you can directly hand over the checks to the payee. Another option is that the checks can be sent to the payee by mail to cash them when required.

Online Check Writer

Key figures

1M+

online business accounts

88B+

transaction volume

16M+

checks processed

Either you write checks manually with a pen, or you can create checks and fill in details online. The number of users in the United States who use checks for cash transactions is on a steep rise. It is much better than doing credit card-based transactions, as it is really secure and does not carry any sort of charges.

There is no particular limit for the amount that can be transacted through checks, and hence it is possible to pay some cents using a check. Obviously, if it is less than a dollar, the check amount consists of a few cents. Checks can be issued to the payee of any amount and the only condition to be met is that your account should have the cash balance that will cover the amount. Otherwise, the checks will get bounced, which leads to legal implications. There are some steps involved while we write a check for under a dollar. Let it be by manual checks or checks online, filling up banking data and other related details are a must.