It’s no secret that the way we pay for things is changing. With the rise of mobile payments and digital wallets, it’s clear that plastic cards are about to go away. Do you have any idea what will replace them? It’s nothing more than virtual cards. Virtual cards are the future of payments, and major companies like Microsoft and Amazon are already using them. This blog post will explore what “virtual cards” are and how they work. We’ll also discuss the benefits of using virtual cards for businesses purpose.

What is Virtual Card?

A virtual card is a type of credit card used for online purchases. It’s not a real card, but a digital one that you can store on your computer or phone. You can use your virtual card to purchase from any store that accepts credit cards and make online payments.

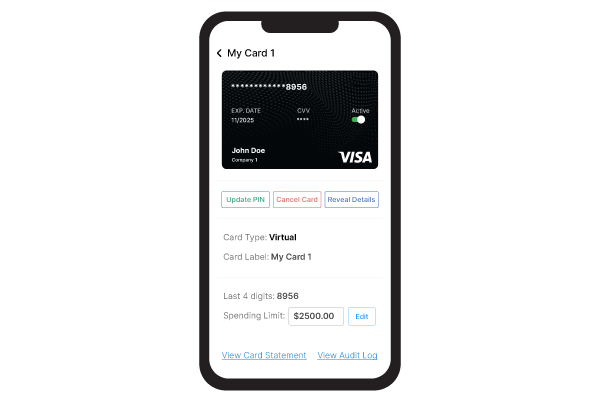

These virtual credit or expense cards work like regular expense cards but don’t need a physical card. They have 16-digit numbers that are made up randomly and include a card verification number and an expiration date. How easy it is to use a physical card versus a virtual card makes them different.

Benefits of using virtual card

There are many benefits of using a virtual card, the following:

- No physical card to lose or steal – your virtual card is safely stored online.

- No need to carry cash or checkbook – your virtual card can be used anywhere that accepts major credit or expense cards.

- Save on fees – many virtual card providers charge lower fees than traditional banks or credit card companies.

- Increase security – since your virtual card is not connected to your bank account, it can help reduce the risk of fraud or identity theft.

- There are many benefits to using a virtual card. For one, it allows you to shop online without entering your real credit card number into websites.

Types of Virtual card

Virtual Credit & Expense Cards

Cards that give you instant virtual credit for upcoming repayments are called virtual credit cards. Like your real expense card, a virtual expense card immediately takes money out of your account when you make a payment.

Corporate Expense Card:

Companies have control over their expenditure when using expense cards for corporate purposes. Since each worker has their card, it’s easier to track who paid for what. This also means that payments are made to the right person and come out of the right budget for the right department. Zil Provides the best corporate expense card for all your business needs.

Virtual Credit Cards vs. Digital Wallets

Your credit and expense card information is stored safely on your smartphone by a digital wallet. You can use it as a contactless payment option if the merchant has the necessary hardware to process contactless payments.

Like a virtual card, most digital wallets will give you a temporary card number every time you make a purchase. This way, the merchant will never see your real card number. However, not all places accept digital wallets. Digital wallets can only be used at participating stores, online or in-store, as opposed to virtual cards, which can be used for any online transaction that accepts credit cards. Zil, a cloud banking service by OnlineCheckWriter.com – Powered by Zil Money, provides the multiple best virtual card for all your business needs.

Safe and Simple Banking

Zil virtual cards are great for conducting secure online purchases. The card acts the same way as a physical card, yet there is no need for one. Because no tangible object can be stolen, fraud is much less likely. You can use your card on your phone or smartwatch to make purchases anytime and limit its use.

Multiple Cards

You can have as many virtual cards for your firm as you desire on a single account. You can issue these cards to several employees with spending limits. Making commercial payments assists in keeping a close grasp on expenditures. It will also display the amount of money accessible to the team members.

How to Send Virtual Visa Gift Card?

- Step 1: Log in to Zil and choose a bank account.

- Step 2: Click on the Send Payment button. Select the Gift Card option from the drop-down menu.

- Step 3: Choose the contact to whom you want to send the visa gift card. Add the amount and necessary details and click send.

Your contact will receive the visa gift card through email instantly.

With the rise of mobile payments and digital wallets, it’s clear that plastic cards are about to leave. Zil virtual cards are great for conducting secure online purchases. The card acts the same way as a physical card, yet there is no need for one. Because no tangible object can be stolen, fraud is much less likely.