Best Way to Use a Credit Card | Maximize Rewards & Cash Flow

Best Way To Use A Credit Card is via this platform, where you can pay and earn rewards on each transaction! The platform provides convenience and flexibility, but it also has many benefits, such as reward points. This platform allows you to maximize these benefits, even when paying vendors who don’t accept credit cards.

OnlineCheckWriter.com- Powered by Zil Money is a fintech, not a bank. FDIC coverage is provided through our partner banks Texas National Bank and Lincoln Savings Bank.

Click Here For Interactive Demo ⬇

1M+

online business accounts

88B+

transaction volume

16M+

checks processed

Using Credit Cards to Save Money on Business Expenses

Accepting payments by credit card isn’t just convenient—it can also support smarter expense management and healthier cash flow.

Cash-Back & Rewards Potential

Earn Value on Spending: Business credit cards such as the Capital One Spark Card offer up to 2% unlimited cash back, while the American Express Plum Card offers 1.5% unlimited cash back on eligible spending.

Offset Processing Costs: Cash-back rewards can help offset the 2.90% processing fee, reducing the overall effective cost of transactions.

Tax Considerations

Deductible Processing Fees: Credit card processing fees may be recorded as deductible business expenses, helping lower taxable income.

Additional Tax Advantages: Depending on jurisdiction and applicable tax regulations, businesses may qualify for additional tax benefits when using credit cards for expenses.

Improved Cash Flow Control

Extended Payment Window: Credit cards typically provide a 30–45 day payment window, giving businesses additional time to manage outgoing payments.

Better Capital Timing: During this window, funds can remain available for operational needs or short-term revenue-generating activities.

Detailed Example: Capital One Spark Card

Process Fee: Standard credit card processing applies (2.90%)

Cash Back: Cash-back or rewards may reduce the effective cost (2%)

Tax Break: Processing fees may be recorded as business expenses (0.06%)

Final Fee: The overall cost can be lower than it appears at first glance (0.35%)

Additional Benefit: 30–45 days of payment flexibility supports cash flow planning.Actual fees, rewards, and benefits vary based on card issuer and usage.

Floating Revenue from Bank

Short-Term Cash Utilization: Funds retained in your bank account during the 30–45 day credit card cycle may earn interest or be used for short-term revenue opportunities.

Strategic Capital Use: The float period allows businesses to deploy capital more effectively for urgent expenses or growth opportunities.

Why This Matters

Accepting credit card payments gives you speed, flexibility, and financial control—without changing how your customers pay.

Additional Resources

Explore how accepting payments by credit card helps you get paid faster, improve cash flow visibility, and simplify payment management - without adding complexity.

Maximizing Credit Card Rewards

OnlineCheckWriter.com brings an innovative solution to this challenge. The unique “Pay by Credit Card” feature enables you to pay your vendors through your credit cards, regardless of whether they accept card payments. This allows you to earn rewards on your credit cards for every payment, leading to significant savings over time.

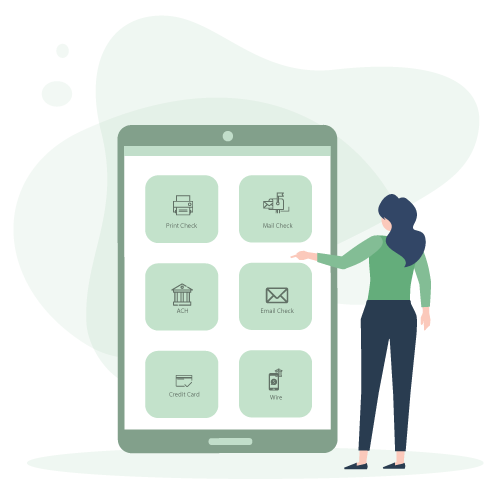

Our Features AP/AR

OnlineCheckWriter.com - Powered by Zil Money offers a wide range of payment features to make your business transactions secure and flexible. Now you can pay and receive payments with the easy-to-use software and dive into the journey.

Check Printing

Create and print business checks at your office desk with a drag and drop design.

ACH

Pay or get paid one-time or recurring ACH/RTP with low transaction fees.

Integration

Integrate with the top third-party applications.

Pay Bill

Pay Bills Online, Schedule them, Manage suppliers, and reduce risk.

Payments by Credit Card

Now pay by credit card even if they don't accept them.

Wire Transfer

Transfer money electronically from one financial institution to other.

Deposit Slips

Instantly create & print the deposit slip of any Bank. Keep track & auto reconcile it.

Invoicing

Create invoice to your customer and send link through email.

Cloud Bank

Open an online checking account with no hidden charges.

Email Check

Send your checks as a one-time printable pdf with a tracking facility.

Payment Link

Create an HTML form or link to receive payments.

User/Approver

Give access to accountant or clients with a role based user and approval process.

Overnight Check Mailing

Overnight Check mailing without leaving your desk. We print and mail it by FedEx.

Digital Checks

Digitize your paper checks and make your payments via email or text.

Bank Data

Connect & reconcile, Categorize from Any Financial Institution automatically.

API/White Label

Interactive developer-friendly API. Complete white label solution.

Effective Payment Platform

The best way to use credit cards is by OnlineCheckWriter.com’s Pay by Credit Card feature that doesn’t stop at just earning rewards. You can also manage your finances more efficiently, helping to keep track of all your payments, whether by check or credit cards. It’s a one-stop platform to manage and monitor all your financial transactions, enhancing your control over personal or business finances.

Easy To Access

Instant Access To Your Account Anywhere, Anytime.

High Security

Secured With Encryption, Fraud Detection, and Infrastructure.

Easy Payment

Efficiently Transfer Funds To Where They're Needed.

Safeguarding Your Credit

Timely payments are crucial in maintaining a healthy credit score. The use of OnlineCheckWriter.com can ensure that your payments are always on time. By scheduling your credit card payments via the platform, you can prevent any adverse effects on your credit score due to late or missed payments. This feature further solidifies the platform’s position as a crucial tool in smart credit cards usage.

MULTIPLE FEATURES, ONE PLATFORM

CONNECT ANY BANK, PREVENT FORGERIES

OPEN A MODERN CHECKING ACCOUNT WITH ZIL US

Enhances Credit Card Usage

The best way to use credit cards is via OnlineCheckWriter.com which enhances the advantages and minimize the challenges associated with credit card use. From maximizing rewards to ensuring timely payments, this platform acts as a comprehensive solution. Use OnlineCheckWriter.com to make the best out of your credit card while also maintaining a firm grip on your financial health.

FREQUENTLY ASKED QUESTIONS

How does credit card payment work?

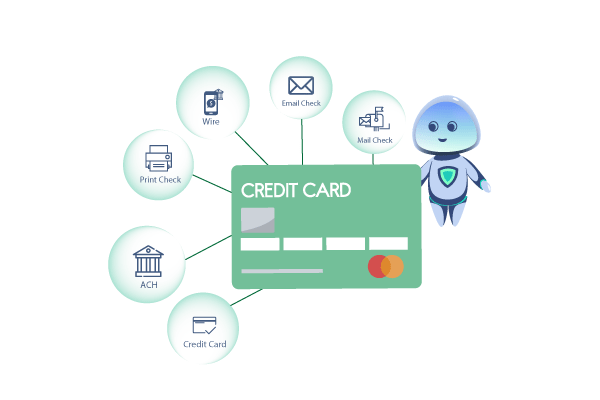

You can make online or in-store payments with your credit cards. Using OnlineCheckWriter.com, you can send money with credit card to anyone without worrying about them accepting credit cards payments. You can choose how they receive it- ACH, Wire, or Check.

Can you send money with a credit card?

OnlineCheckWriter.com encourages you to send money with credit cards to anyone without worrying about the transaction cost for the payee. You can choose how the payee will receive the amount and keep all the credit card rewards.

How to use credit card to transfer money?

Switch to OnlineCheckWriter.com and choose the pay by credit card feature to easily make payments. The platform allows using credit cards to send money, even to those who do not accept them. You can choose how the payee will receive it.

Credit Card vs Cash Spending

Credit cards and cash are two common methods for transactions. Utilize your business credit card to make payments through OnlineCheckWriter.com, even if they are not accepted.

Credit card vs Debit

Credit and expense cards are the two common modes of card payment. Credit cards payments are not commonly accepted by all, unlike expense cards. Join OnlineCheckWriter.com and make credit card payments even when they are not accepted.

REVIEWS FROM ESTEEMED CUSTOMERS

Here are some precious reviews from G2 – Business Software Reviews. We are pledged to make your life simple with all our features.

You will love OnlineCheckWriter.com. We are sure.

We are confident to offer a 15-day free trial.

No credit-card required for free trial.

Trial period comes with full features: unlimited checks, bank accounts, users/ employees, etc.