You recognize the significance of keeping an eye on your company’s finances as a small business owner. It will take more work to collect data for your check register manually. Don’t worry, we have a solution for you, are you wondering what the solution will be? It’s really simple start using our platform OnlineCheckWriter.com – Powered by Zil Money to reconcile all your bank data in one place. Integrate all your bank accounts and control them in one place.

What is a check register?

A check register records your company’s check and cash transactions during an accounting cycle. A check register is used by businesses to determine the running value of their checking account. It’s also called the cash disbursements journal.

You will have a distinct business check register for each checking account, depending on the requirements and preferences of your company. Get all your bank data at one place for easy management

Check registers usually have elements that are explained below:

- Date of transaction.

- Check the number or category (e.g., electric bill).

- Notes or description.

- Credits and debits associated with the transaction.

- Account balance.

Benefits of using a check register

A check register is an important part of your accounting process. There are many benefits some of them are listed below:

- Avoid overspending.

- Budget better.

- Keep your transactions up-to-date and organized.

- Seeing the exact balance.

- Track you spending.

- Find mistakes.

- Reconcile bank statements.

How to keep your check register up to date?

Keeping the check register up to date doesn’t need to be a difficult exercise. It is easy, here is some of the thing to keep in consideration:

- Timing and Volume.

- Cost.

- Monitoring.

- Knowledge and Know-how.

- Staffing availability.

- Cost of compliance.

How to record transaction in check register?

When it comes to entering transactions in your check register, you, as a business owner, have a few alternatives. You can:

- Make manual paper records of your transactions.

- Utilize a spreadsheet.

- Make use of accounting software.

Manually creating your check register can be time-consuming and leave room for errors.

A spreadsheet is an improvement over a manual check register. This still requires you to enter data. You can put up formulas to perform the balance calculations for you, depending on the spreadsheet you’re using.

Transactions in your check register can be organized with the use of simple accounting software. The software can give you a snapshot of your transactions for the time period and can keep you informed of your running balance. The software may allow you to attach a file to a transaction or sort the register by a specific date. If you are looking for the best platform to manage check registers, OnlineCheckWriter.com is there for you.

Check register and Bank account

Open a business checking account to better manages your check register. Using a business bank account, you can distinguish between personal and business costs. Budgeting, financial reporting, and tax preparation can all be complicated by combining personal and commercial transactions.

Online Checkbook Balancer

By connecting to multiple banks and giving software to help customers balance checkbooks, the online platform assists users in managing their finances. Users can keep track of all their transactions in one location by connecting to multiple banks. The platform includes solutions for budgeting, checkbook balance, and bank reconciliation.

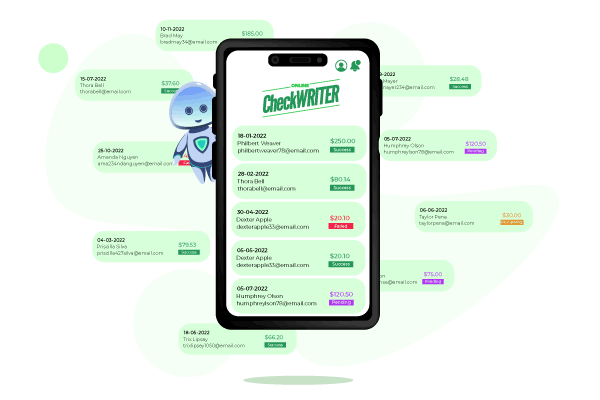

OnlineCheckWriter.com Provides One of the Best Checkbook Register

Our platform’s check register makes it easier to keep track of all transactions involving personal, bank, and commercial accounts. If you have numerous accounts, you can quickly add them all and manage them from one location. All of your information is safe with us thanks to our cutting-edge cloud-based technology, which enables users to keep all of their check transactions online. The check register can be utilized to handle payments and keep track of previous transactions.

You can keep track of all your transactions in one spot with the use of an online check register. You will receive a thorough accounting of all your check transactions as a result. You can also keep track of all your transactions in one location in addition to this.

In order to keep track of your business spending, having a check register is crucial. This provides you with a clear picture of the types of purchases your company is making and helps you determine whether you need to adjust your spending. So, in order to track his costs, a business owner requires a check register. It is easier to switch to OnlineCheckWriter.com because it will manage your check register for you automatically.