Businesses today rely on their employees to get the job done and produce the necessary revenue to keep the company going. Paying your employees is one of the most important things you can do to ensure they’re happy and motivated, paying them on time will be the best way to do so. Payroll by credit card QuickBooks helps you manage your payroll and pay your employees anytime, anywhere, keeping your cash flow intact! Use OnlineCheckWriter.com – Powered by Zil Money and pay payroll using a credit card.

What Is a Credit Card?

A credit card is a small, rectangular piece of plastic or metal that a bank or other financial institution issues. It lets the person who has it borrow money to pay for things at stores that accept credit cards. With a credit card, you have to pay back all the money you borrowed, plus any interest and other agreed-upon fees, by the billing date or later.

What is Credit Card Processing?

Many processes begin immediately behind the scenes when a customer uses a credit card to purchase. The transaction process is made up of these steps. It starts when the cardholder enters, swipes, inserts, or taps a credit card. When it says “authorized” or “declined,” the transaction has been processed.

What is a Payroll?

Payroll is the amount of money an organization must pay its employees for a specific period or date. It is typically managed by a company’s accounting or human resources departments. Payroll may be handled by the owner or an employee in a small business. Payroll is the process of paying the employees of a business. This means keeping track of their hours, figuring out how much they should be paid, and giving them their money by direct deposit or check.

Payroll vs Accounts Payable

Accounts payable is a type of current liability. Accounts payables are things that the company owes and is invoiced for.

Payroll costs are the costs associated with paying your employees. Payroll is not a unified account. It includes salaries, wages, payroll taxes, and taxes taken out of paychecks.

Payroll is a current liability that must be paid, but it is kept track of separately from accounts payable. To record payroll, you need to use both expense and liability accounts. Because the employer has to take out taxes for the federal government, they have to use payable accounts to record payroll. These accounts are examples of taxes due under the Federal Insurance Contributions Act and state income taxes.

Payroll by Credit Card

OnlineCheckWriter.com’s payroll by credit card and QuickBooks integration can help you manage your cash flow and payroll more efficiently. When you use your credit card, you can earn reward points. Also, paying with a credit card can speed up the payment process, even if the situation is urgent. Payroll processing with a credit card has several advantages, including convenience and adaptability.

Payroll by credit card QuickBooks lets you manage your payroll and pay your employees whenever and wherever you want, so your cash flow stays the same. You must link your QuickBooks account to OnlineCheckWriter.com, and we’ll handle your payroll payments by paying your employees via ACH or check.

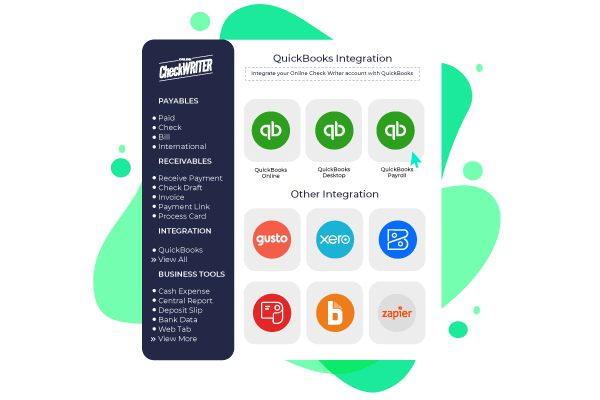

Banking and Financial Software Integration

Thanks to the integration with QuickBooks, it is simple to process payroll by credit card online with OnlineCheckWriter.com. Bank reconciliation solutions allow for the recording of transactions, as well as the printing of checks from a variety of financial institutions. In addition, this will prevent unauthorized checks from being processed against your account.

Similarly, integrating your financial accounts with accounting software like ADP, Gusto, or Zoho helps you stay in charge of your finances. As a direct result, you won’t have any trouble importing checks from the software to OnlineCheckWriter.com and printing checks right from the website!

Payroll by credit card QuickBooks is a great way to manage your payroll and pay your employees. Using our platform, OnlineCheckWriter.com, you can easily use a credit card to give payroll without any extra charges. With the easy integration with OnlineCheckWriter.com, there’s no reason not to try it out for yourself!