Businesses are continually seeking efficient and convenient ways to manage their payments. One such innovation that has gained attention is the concept of a “bank draft.” Specifically, through OnlineCheckWriter.com – Powered by Zil Money, businesses in the United States have found a perfect method to create bank draft using their phones.

Evolving Bank Drafts

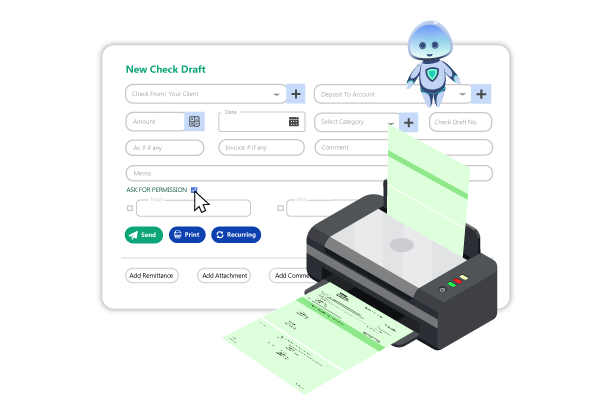

OnlineCheckWriter.com has emerged as a leading platform empowering businesses to create bank drafts easily through their phones. The platform’s user-friendly interface and strong features have made the process simple, making it accessible for businesses of all sizes.

Understanding Bank Draft

Unlike a traditional check where specific details are filled out beforehand, a bank draft allows for the completion of essential information at a later time. This flexibility offers a range of advantages for businesses, allowing them to control the payment details as needed while ensuring security and ease of transaction.

Convenience at Fingertips

This software’s capacity to produce bank drafts via phone offers convenience, enabling businesses to generate drafts quickly with a few taps. This efficiency saves important time and resources, guaranteeing proper and efficient transaction management irrespective of location or time constraints. Its accessibility transforms the process, ensuring effortless handling of transactions. This transformative feature empowers businesses, optimizing operations and increasing productivity. Making the creation of bank drafts easy through mobile devices, this software is evidence of technological advancement, enhancing convenience and rapidity in financial dealings.

Enhanced Security Measures

Security remains a top priority in financial transactions. The cloud-based platform includes strong security measures to safeguard sensitive information. Encryption protocols and multi-factor authentication mechanisms ensure that each transaction is conducted with the utmost security, reducing the risks related to financial dealings.

Customization and Flexibility

One of the standout features of the platform’s bank draft services is its customization level. Businesses can create the draft to meet specific payment requirements, whether it’s adjusting the amount, adding payee details, or setting a future date for the transaction. This flexibility empowers businesses to manage their finances efficiently while maintaining full control over their transactions.

Cost-Effectiveness and Efficiency

Traditional payment methods often come with additional costs and lengthy processing times. The check printing software eliminates these drawbacks by offering a cost-effective solution with quick processing times. The platform’s well-organized approach minimizes additional expenses associated with traditional payment methods, contributing to overall cost savings for businesses.

The Future of Payments

As technology continues to advance, the way businesses manage payments evolves accordingly. The invention of OnlineCheckWriter.com signifies a shift toward more accessible, efficient, and secure payment solutions. The convenience of creating bank drafts through a smartphone defines the direction in which financial transactions are heading—a future where flexibility and convenience are vital.

For US businesses, using bank drafts via this platform is a significant step in reducing down on payment procedures. It changes the financial transactions industry with its sophisticated security measures, customizable options, and easy-to-use interface. As businesses look for fresh and innovative approaches to problems, this user-friendly platform opens the door to a financial ecosystem that is becoming more safe and efficient.