Individuals and businesses alike require simple methods for sending and receiving money online, and one of the most popular is through an ACH money transfer. When you need to pay bills, make a purchase, or send money, an ACH money transfer can make all the difference. OnlineCheckWriter.com – Powered by Zil Money provides a cloud-based banking platform Zil that lets you and your business do an ACH transfer for a reasonable fee.

What is an ACH Transfer?

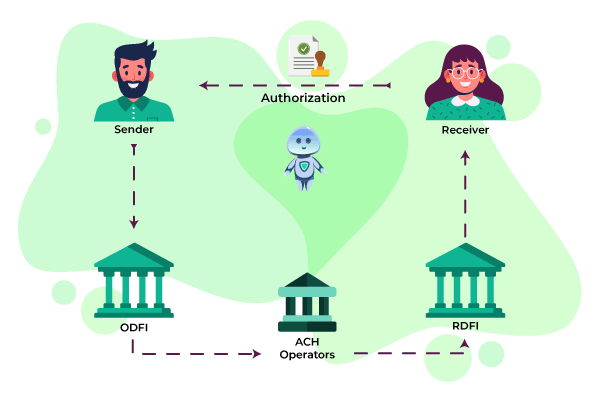

ACH transfers are when you move money from one bank account to another using the Automated Clearing House network. ACH transfers are a way to pay for things electronically. People often use them to make direct deposits or pay bills automatically. The Automated Clearing House Network processes transactions in batches three times a day. This means that there is less time between sending money and getting it than with other methods.

Types of ACH Money Transfers

Automatic clearing house payments are classified into two types. Both these types of processes are essentially the same, but they differ in cost and speed. They are as follow:

ACH credits:

Both the payer and the recipient must give their consent for an ACH credit to be made. Both the party making the payment and the party receiving the funds must approve the exchange for it to go through. Once both sides of the authorization are done, the transaction can be finished by hand or easily set up as a payment that happens regularly.

ACH debits:

An ACH debit withdraws funds from the account being paid. This means that the payment is initiated by the person receiving the money (the payee). It’s a common method used by businesses to collect debts. These businesses occasionally use the terms “autopay” or “ACH” interchangeably with the term “ACH debit.”

Same Day ACH

NACHA decided to shorten ACH processing times in 2015. Until that point, ACH transfers had typically taken two to five business days to process. Following years of lobbying from customers and industry experts, the governing body voted to proceed with a campaign dubbed “same-day ACH.”

NACHA approved a plan in 2015 to implement two new settlement windows each business day: one at 1:00 p.m. EST and one at 5:00 p.m. EST. These two new timeslots were added to the existing 8:30 a.m. EST time slot.

What Is Required for an ACH Transfer?

If you have the necessary information, making an ACH money transfer is simple. To make an ACH money transfer, you must provide the following information:

- Name.

- Routing/ABA number.

- Account number.

- Bank account type (business or personal).

- Transaction amount.

ACH vs Wire vs Direct deposit

ACH transfers are electronic transfers of funds from one bank account to another. This is accomplished through the use of an ACH network. Wire transfers involve physically moving money from one bank account to another. This method is faster, but it is more expensive.

A central clearing house processes and handles ACHs. This is a process that is done automatically and usually takes between one and several business days. Wire transactions, on the other hand, entail speaking with a bank representative in order to transfer money from one account to another. They are usually extremely fast.

Wire transfers are more expensive than ACH transfers because they are one-time transactions and must be handled manually. Although they are faster, funds cannot be reversed, making them less secure.

The distinctions between ACH transfers and direct deposits are more complicated. People frequently mix them up. The most important thing to remember is that direct deposits are electronic payments processed by a third party upon the receiver’s request. ACH transfers can be made both to and from your account. Direct deposits can only be used for one-way payments.

How OnlineCheckWriter.com Can Assist You?

ACH payments involve two people. One person pays, and the other person gets paid. The first person is called the initiator, and the second is called the receiver.

- With OnlineCheckWriter.com, the initiator can make a transaction from anywhere, anytime.

- The initiator will be asked to provide checking account details, such as the recipient’s routing and bank account numbers.

- The receiver’s bank information and transaction amount can be found in the ACH files, along with many other parameters and formats.

- The receiver’s bank debits the amount from the initiator account.

- The receiver’s account gets credited.

Other benefits include the ability to send money instantly through wire transfers, manage your payroll, create and manage invoices for your business, design, customize, and print checks on-demand, and manage all of your bank accounts from one platform, among many others.

Start using OnlineCheckWriter.com today and take advantage of features like wire and ACH transfer, and many others to see how quickly your company’s finances will improve. You can transfer money and print checks using our simple platform. You can also use our platform to pay bills, run payroll, and access a variety of other features.