Payroll is an essential aspect of any business, regardless of size or industry. It refers to calculating, processing, and distributing salaries, wages, and other forms of compensation to employees. The payroll system is complex and requires careful management to ensure compliance with various laws and regulations. With the payroll software from OnlineCheckWriter.com – Powered by Zil Money, businesses can manage payroll effectively and efficiently.

Definition of Payroll

Payroll is the process of calculating and distributing salaries and wages to employees. It includes calculating the hours worked, deductions, bonuses, and taxes. A payroll system ensures that employees are compensated accurately and on time. It is an integral part of any business operation and requires proper management to avoid errors, omissions, or legal violations.

Payroll Process

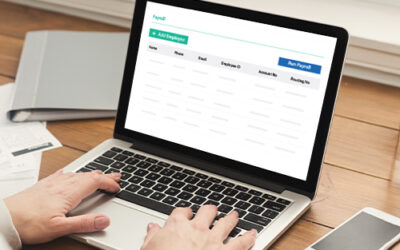

The payroll process involves several steps, including collecting and verifying employee data, calculating pay, deducting taxes and other withholdings, distributing paychecks, and maintaining accurate records. The process can be time consuming and requires high accuracy to ensure compliance with tax laws and other regulations. The following are the steps involved in the payroll process:

Collecting and verifying employee data: The first step is to collect employee data such as name, address, social security number, and tax withholding information. This data must be verified to ensure accuracy and compliance with tax laws and other regulations.

Calculating pay: The next step is calculating the employee’s pay based on the number of hours worked, deductions, and bonuses. This requires an understanding of federal, state, and local tax laws and any other regulations that may affect payroll.

Deducting taxes and other withholdings: After calculating pay, taxes and other withholdings such as health insurance premiums, retirement contributions, and wage garnishments must be deducted from the employee’s salary.

Distributing paychecks: The final step is to distribute paychecks to employees through direct deposit or paper checks. Accurate record-keeping is essential to ensure all employees are paid correctly and on time.

These complex processes can be efficiently completed with OnlineCheckWriter.com.

Payroll Taxes, Compliance, and Regulations

Payroll taxes, compliance, and regulations are significant aspects of the payroll process. Employers are responsible for withholding and paying various taxes on behalf of their employees, including federal income tax, Social Security tax, Medicare tax, and state and local taxes. Failure to comply with these tax laws can result in hefty penalties and legal consequences.

In addition to taxes, employers must comply with various regulations and laws governing payroll.

Employers must maintain accurate and detailed records of their payroll activities to ensure compliance with payroll taxes and regulations. OnlineCheckWriter.com is one platform to manage all these tasks in one place.

Payroll Mistakes

Payroll mistakes can have significant consequences for employers and employees. Common payroll mistakes include incorrect calculation of overtime pay, misclassification of employees, failure to withhold or remit taxes, and inaccurate record-keeping. These mistakes can result in fines, penalties, and legal disputes.

To avoid payroll mistakes, employers should invest in a reliable payroll system like OnlineCheckWriter.com, train their staff on payroll laws and regulations, and regularly review their payroll records for accuracy.

Payroll Software and Its Benefits

Payroll software is an essential tool for managing payroll. It automates many of the time-consuming and complex tasks involved in the payroll process, such as calculating pay, deductions, and taxes. The benefits of payroll software include the following:

Time-saving: Payroll software can significantly reduce the time required to complete payroll tasks. Automated calculations and data entry minimize errors and save time that would otherwise be spent on manual calculations.

Accuracy: Payroll software is designed to minimize errors and ensure accuracy in payroll calculations. This reduces the risk of overpayments, underpayments, and tax errors, which can result in legal and financial consequences.

Cost-effective: While payroll software can require an initial investment, it can ultimately be cost-effective. The time and resources saved by automating payroll tasks can result in significant cost savings over time.

Compliance: Payroll software can help ensure compliance with tax laws and other regulations. The software can automatically calculate and deduct taxes, generate tax forms, and maintain accurate records, reducing the risk of legal and financial consequences.

Employee Self-Service: Many payroll software solutions offer self-service portals where employees can view their pay stubs, tax information, and other payroll-related information. This can reduce the administrative burden on HR staff and improve employee satisfaction.

Conclusion

Payroll is a critical aspect of any business operation, and proper management is essential to avoid legal and financial consequences. Payroll software is an essential tool for managing payroll and can provide numerous benefits. Employers should carefully evaluate their payroll needs and consider investing in a payroll software solution such as OnlineCheckwriter.com to streamline their payroll process and ensure compliance with tax laws and other regulations.