A void check is a check that has been canceled and is no longer valid for payments. Void checks can be created for various reasons, from correcting an error on the check or stopping payment on a check that has been lost or stolen. You can do a void check manually or online. Voiding check online is simple, thanks to OnlineCheckWriter.com – Powered by Zil Money. So start using our platform and experience the simplified way of getting checks online.

What Is a Check?

A check is a document that allows a bank to pay a specific amount of money to the bearer. The person who writes the check is known as the drawer or payor. Meanwhile, the payee is the person to whom the check is written. The drawee, in this case, is the bank on which the check is drawn.

The payee can present checks to a bank or other financial institution. This occurs because the payee wishes to negotiate. After that, the funds are transferred from the payor’s bank account.

Print any checks from the comfort of your home using our platform OnlineCheckWriter.com.

Void Check Definition

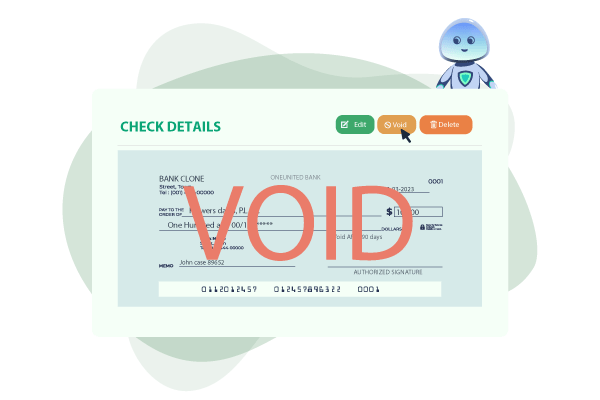

A voided check is easily identified by the word “VOID” written across the front of the paper check. To avoid accidental use, the sign is usually written in large letters. To put it simply, a voided check is a cancelled check. Therefore, it cannot be used to withdraw funds from a deposit account.

When you void a check, you disable it, and it no longer functions as a blank check. Assume a thief steals this cancelled check. The thief cannot write down a sum of money and then use it to obtain cash.

Companies frequently request voided checks from new employees. They require them to set up direct deposits so the new employee can receive their pay. The accountant might ask for more information instead of a voided check, but giving one ensures there are no mistakes.

The obvious reason why companies never ask for blank checks is to ensure that employees’ checks are not used and spent.

Void your check digitally using our platform, OnlineCheckWriter.com.

How to Void a Check

Voiding a check is a simple process, but it’s important to do it correctly to ensure that the check is no longer valid. Here are the steps to void a check:

- Step 1: Starts with a Check That Is Blank

When you send in a voided check for direct deposit or automatic payments, you don’t need to write anything on the regular lines. Obtain a blank check from your checkbook, and then proceed to the next step.

- Step 2: With Blue or Black Ink, Void Check

Write “VOID” in large letters across the entire front of the check, and be careful not to cover the routing or account numbers. This is because those numbers will be used by the person receiving the voided check to identify your checking account.

- Step 3: Make a duplicate of the voided check.

Make a copy of the voided check to send to your employer or anyone else who needs it. Keep the original to remind yourself that the check with this number was not used for a specific payment.

You can use duplicates or photographs of the same voided check for multiple purposes.

Why Would You Void a Check?

There are several reasons why you might need to void a check. Some of the most common reasons include:

- Set up automatic deposits. The employer obtains the information required to link a direct deposit to the employee’s bank account. Every payday, the employee receives the funds directly into their deposit account.

- Automate payments. People can use online banking or automate their payments instead of paying for regular expenses in person at a financial institution. For example, payments for bills, rent, loans, and other regular expenses are automatically deducted from a bank account each month.

- Error on the check: If you make an error on a check, such as writing the wrong amount or date, you may need to void the check and start over.

- Stop payment: If you lose a check or it is stolen, you can request a stop payment from your bank. This will prevent the check from being cashed and you can void it to ensure that it cannot be used.

- Allowing an employer to use direct deposit to receive expense reimbursements.

Voiding a check online is a convenient and secure method. With just a few clicks, payers can easily void a check and avoid the potential risks and complications arising from physical alterations or outdated payment methods. In addition, online platforms and mobile applications provide users with reliable and secure options for voiding checks, ensuring that payments are cancelled quickly and efficiently. If you are looking for one of the best check printing platforms and to void check online, look no further than OnlineCheckWriter.com.