The financial system keeps getting better and safer for regular people to use. Employees like yourself no longer have to worry about providing paychecks because of the convenience of direct deposits. Direct deposits will simplify your employees’ pay by transferring their pay automatically into their bank accounts. OnlineCheckWriter.com – Powered by Zil Money allows you to add and manage all your bank accounts in one place. Using our platform, you can now manage and send your payroll from a single location.

Direct Deposit

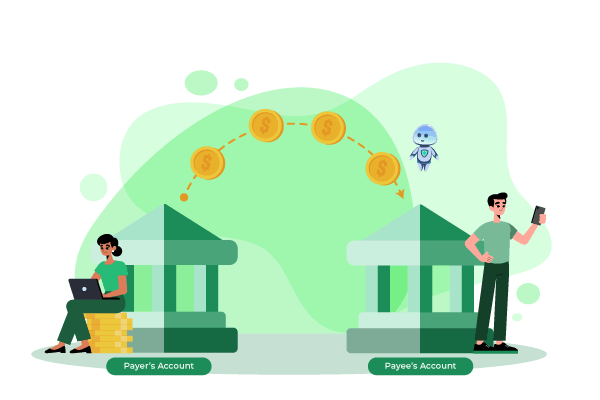

The term “direct deposit” refers to the electronic deposit of funds into a bank account rather than the use of a physical, paper check. An electronic network that facilitates interbank deposits is necessary for direct deposit to function. This network is known as an “automated clearing house” (ACH). Since the funds are transferred electronically, the accounts of the recipients are automatically credited; therefore, there is no need to wait for the funds to clear.

How to Set Up a Direct Deposit?

Setting up a direct deposit can take a few days. In order to make a deposit, you must first gather the necessary data and then input it into your banking system. The money is sent electronically and deposited into the recipient’s account at 12:00 AM on the payment date. Since the ACH clears the funds automatically, they are available right away, so the bank doesn’t need to put a hold on them.

For the deposit to be completed, the sender needs the following details from the recipient:

- Bank name.

- Account number.

- Bank routing number.

Alternatively, they can also be provided with a void check that has the same information printed on it.

Use of Direct Deposit

This method is commonly used to transfer an

- Salary of the employee.

- Refunds of taxes.

- Returns on investments.

- Payments from retirement accounts.

- Social Security and other government benefits.

- Direct deposits from debtors to creditors are another way to pay bills.

Disadvantages of Direct Deposit

Employers and employees both benefit from direct deposit. But there are a few things that could go wrong

For the Company, the Cons of Direct Deposit Include:

- You can’t stop payment like you can with a paper check.

- Employees must complete new authorization forms if their bank changes, which also changes their direct deposit information.

- There could be some up-front expenses associated with establishing financial accounts and implementing a system for direct depositing funds.

- To protect the employees’ bank routing and account numbers, the company must implement security measures.

For the Employee, the Cons of Direct Deposit Include:

- Even though it doesn’t happen often, when an employee is required to provide bank information to be entered into the employer’s database, that creates one more place where the employee’s bank account information is vulnerable to online hacking.

- If an employee changes banks, they have to change their direct deposit information, which means they have to fill out new authorization forms.

- While switching banks, the employee must keep their old account open until the new account begins receiving deposits, which can take several weeks.

- Before writing checks against the deposit, the employee should make sure that the electronically deposited funds are in their account and available, just like they would do with a paper check.

ACH vs Direct Deposit

ACH deposits are done electronically, so there’s no need for paper checks or cash. These transactions are handled by the Automated Clearing House network, and you can get your money in 2–5 days.

A direct deposit is when money is put directly into a bank account. Instead of using a paper check, this deposit is made electronically. It’s a quick and easy way to send money.

The concept of an ACH transfer is similar to that of a direct deposit in that both are conducted electronically. They help us use less physical money and checks. Since direct deposits are just one kind of ACH deposit, any money that is deposited into your bank account is counted as both an ACH deposit and a direct deposit.

Now send money using ACH and direct deposit with OnlineCheckWriter.com and manage all your account at one place.

Is ACH and Direct Deposit Worth It?

Electronic funds transfers, such as ACH and direct deposits, are safer and more reliable than paper checks. Checks and cash have the potential to go missing or be stolen. Payment delays can also result from human error, such as when a check bounces or an incorrect amount of cash is received. Automatic clearing house (ACH) and direct deposit allow for recurring payments, which eliminates the need for human intervention. You can also save time and money by not having to physically visit a bank branch to access your funds when using ACH or direct deposits.

Most businesses, find that the benefits of direct deposit far outweigh the problems that could arise. Using direct deposit for payroll is more efficient than using a payroll check. Set up direct deposits quite easily using OnlineCheckWriter.com and manage all your business bank accounts in one place. Direct deposit will improve the overall efficiency, and both the employer and the employee will prefer this method as it is a simpler, more reliable, and direct way to get paid.