Direct Deposit

Direct Deposit is one of the most convenient ways to transfer money. The cloud-based platform seamlessly handles the ACH transfer, which is regulated by NACHA. Through the recurring ACH facility, you can regularly deposit funds to payees or collect client payments before the due date. Furthermore, the platform offers wire transfers, check drafts, checks by mail, and eChecks.

OnlineCheckWriter.com- Powered by Zil Money is a financial technology company, not a bank. OnlineCheckWriter.com offers banking services through partnership with FDIC member banks Texas National Bank. Customers are not directly insured by the FDIC - but through the pass-through coverage of our partner banks and is conditional on proper titling, record-keeping, and custodial arrangements.

TRUSTED BY MILLION PLUS USERS

NACHA

Our Features AP/AR

OnlineCheckWriter.com - Powered by Zil Money offers a wide range of payment features to make your business transactions secure and flexible. Now you can pay and receive payments with the easy-to-use software and dive into the journey.

Check Printing

Create and print business checks at your office desk with a drag and drop design.

ACH

Pay or get paid one-time or recurring ACH/RTP with low transaction fees.

Integration

Integrate with the top third-party applications.

Pay Bill

Pay Bills Online, Schedule them, Manage suppliers, and reduce risk.

Payments by Credit Card

Now pay by credit card even if they don't accept them.

Wire Transfer

Transfer money electronically from one financial institution to other.

Deposit Slips

Instantly create & print the deposit slip of any Bank. Keep track & auto reconcile it.

Invoicing

Create invoice to your customer and send link through email.

Cloud Bank

Open an online checking account with no hidden charges.

Email Check

Send your checks as a one-time printable pdf with a tracking facility.

Payment Link

Create an HTML form or link to receive payments.

User/Approver

Give access to accountant or clients with a role based user and approval process.

Overnight Check Mailing

Overnight Check mailing without leaving your desk. We print and mail it by FedEx.

Digital Checks

Digitize your paper checks and make your payments via email or text.

Bank Data

Connect & reconcile, Categorize from Any Financial Institution automatically.

API/White Label

Interactive developer-friendly API. Complete white label solution.

Same Day ACH

Recurring ACH

Easy To Access

Instant access to your account anywhere, anytime.

High Security

Secured with Encryption, Fraud Detection, and Infrastructure.

Easy Payment

Efficiently transfer funds to where they're needed.

All-In-One Solution

OnlineCheckWriter.com – powered by Zil Money, is a flexible financial platform that simplifies fund management for both businesses and individuals. It seamlessly integrates with banks and accounting apps, making financial management easy. The platform supports recurring and bulk payments, along with secure payment options such as wire transfers, checks, payment links, and cards.

FREQUENTLY ASKED QUESTIONS

What is ACH?

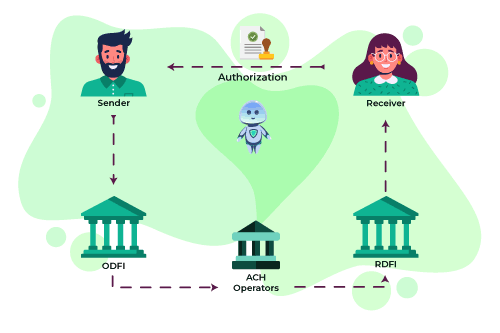

ACH stands for Automated Clearing House, the U.S. financial network for electronic payments and money transfers. OnlineCheckWriter.com - powered by Zil Money, offers same-day ACH processing at affordable costs.

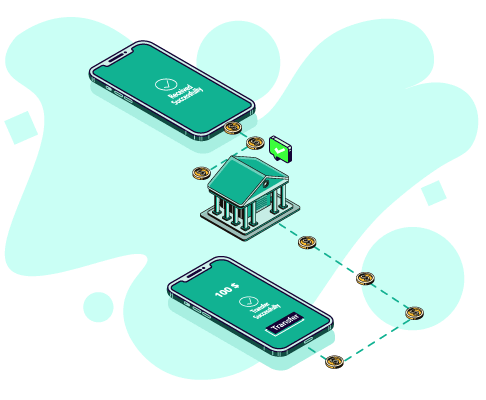

What is ACH transfer?

ACH transfers are electronic bank-to-bank payments in the United States through the ACH network. Funds move between banks using a centralized system managed by the National Automated Clearing House Association (NACHA). OnlineCheckWriter.com - powered by Zil Money, offers a recurring ACH service, allowing you to make regular payments to your vendors or collect payments from clients ahead of schedule.

How long does ACH transfer take?

ACH transfers usually take one to two business days to deliver and settle. OnlineCheckWriter.com - powered by Zil Money, an official member of NACHA, offers customers same-day ACH transactions on its platform.

ACH Transfer vs Wire

ACH transfers are electronic bank-to-bank transfers typically used for domestic payments, offering a low-cost option but may take a few days to process. Wires, on the other hand, provide faster, same-day transfer of funds but are often more expensive due to higher fees. OnlineCheckWriter.com - powered by Zil Money, provides ACH and wire transfers at affordable costs.

REVIEWS FROM ESTEEMED CUSTOMERS

Here are some precious reviews from our customers. We are pledged to make your life simple with all our features.

Frank Czar

Bimal Daftari

Travis Copeland

Frank Czar

Bimal Daftari