eCheck, or electronic check, is a new way to pay for goods and services online. Unlike a traditional paper check, an eCheck can be processed quickly and securely without needing a physical check to be mailed or deposited. eChecks can be used to pay bills online or to send money.

Paying bills electronically is becoming increasingly popular, as it is a convenient way to send and receive payments. OnlineCheckWriter.com – Powered by Zil Money offers a platform to pay and receive eCheck and printable checks, one-time or recurring, via email and SMS. You can also convert a received paper check to electronic transfer using the information found in the check. This secure and efficient service makes it an excellent option for those who want to streamline their payment process. In addition, it is easy to use and can be accessed from anywhere with an internet connection.

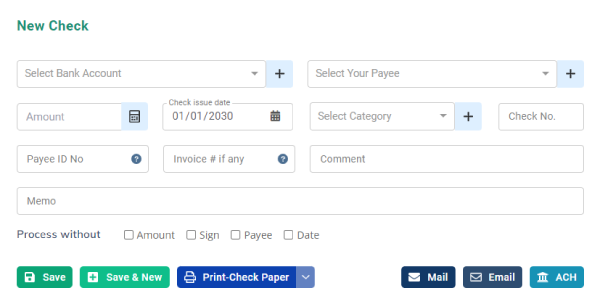

Click Here For Interactive Demo ⬇

Online Check Writer

Key figures

1M+

online business accounts

88B+

transaction volume

16M+

checks processed

Benefits of Using eCheck

There are many benefits of using eCheck over traditional paper checks. eCheck is more efficient, more secure, and more convenient.

Efficient: With eCheck, there is no need to wait for the check to clear the bank. The funds are transferred immediately, which speeds up the entire process.

Secure: eCheck is a more secure way to pay than paper checks. Your account information is encoded and transmitted securely, so it is much less likely to be intercepted and used fraudulently.

Convenient: eCheck makes it easy to pay bills and make other payments from anywhere with an internet connection. You can set up automatic payments, so you never have to worry about forgetting to pay a bill again.

eCheck or ACH Transfer

eCheck is an abbreviation of the term “electronic check” and is more of a payment than a process. These electronic checks are now being used to replace traditional paper checks. ACH is a process of moving money from one bank to another through an Automated Clearing House (ACH).

This electronic check is processed through the ACH network and deposited into the payee’s bank account. One of the main benefits of using eChecks is that they are more secure than traditional paper checks. When a paper check is created, the payer’s bank account information is printed on the bottom of the check. This information can be easily stolen if the check falls into the wrong hands. With an eCheck, the payer’s bank account information is not printed on the check. Instead, it is securely stored in the payee’s online banking portal. Another benefit of eChecks is that they are more efficient than traditional paper.

eCheck or Wire Transfer

An eCheck is an electronic version of a traditional paper check. Unlike wire transfer, which moves money from one bank to another on a one-time basis, an eCheck is processed in batches, allowing for a more efficient and secure way to send payments. eChecks are growing in popularity as they offer several advantages over traditional paper checks. For example, eChecks can be processed more quickly and with more minor errors. In addition, eChecks are more secure than traditional checks, as they cannot be lost or stolen and are more difficult to forge. Overall, eChecks offer a more convenient and efficient way to make payments, making them an attractive option for businesses and individuals.

Why Make the Switch from Paper to eCheck?

There are many reasons to make the switch from paper to eCheck. Perhaps you’re looking for a more efficient way to pay your bills, or you want to reduce your environmental impact. Whatever your reason, making the switch is easy and can save you time and money.

Here are a few reasons to make the switch from paper to eCheck:

1. Save time: With eCheck, you can pay your bills in a fraction of the time it takes to write a paper check.

2. Save money: You will save on postage and checks and may even qualify for discounts from some companies when you pay by eCheck.

3. Reduce clutter: Say goodbye to paper clutter and stacks of bills. Everything is stored electronically when you pay by eCheck to access it anytime, anywhere.

4. Be more eco-friendly: By paying by eCheck, you will help reduce your environmental impact. Paper checks use valuable resources like water and trees, so switching to eCheck is a great way to be more eco-friendly.

Making the switch from paper to eCheck is easy and can offer many benefits.

How to Send an eCheck

To send an eCheck, you must have the email address of the person to whom you sent the payment. Once you have sent the email, the recipient will receive a notification informing them that they can print the check on blank paper and deposit it like a regular check. Additionally, if the recipient is using a mobile device to deposit the funds, they can opt to print the check on standard white paper. Either way, once the check is deposited, the funds will be transferred from your account to theirs. Sending an eCheck is a convenient way to pay someone without having to write a physical check or worry about losing it. Plus, there are no fees associated with sending or receiving eChecks.

Some Things to Keep in Mind When Using eCheck

There are a few things to keep in mind when using eCheck:

– Make sure that you have a secure internet connection.

– Keep your Antivirus software up to date.

– Do not open attachments from unknown sources.

– Do not click on links from unknown sources.

– Be cautious of phishing scams.

Switching to eCheck can help save you time, money, and worry. With an electronic payment method, you can pay bills directly from your bank account without the need to write a check or worry about postage. Plus, electronic payments are more secure than paper checks, so you can know your payments will be safe. If you want to switch, follow these steps to get started in no time!