Payroll services are an essential component of running a business. However, managing payroll can be time-consuming and complex, and it’s important to get it right to avoid costly mistakes. Payroll software automates many payment services, Keep reading to know more about Payroll services and the best platform for making payroll management and services simple.

What Is a Payroll?

Payroll is the amount of money an employer has to pay its workers for a certain amount of time for their services. Usually, a company’s accounting or human resources departments are in charge of it. However, in a small business, the owner or an employee may be in charge of payroll. Payroll is how you pay your workers for the work they do.

What are Payroll Services?

Payroll services manage and process employees’ salaries, wages, and taxes. Calculating employee salaries, withholding taxes, other deductions, and distributing paychecks or direct deposits are all part of the payroll process. Payroll services can be handled in-house or by a third-party provider.

Payroll Services Processing

There are many different parts to processing payroll, but here are the main steps:

- The business decides how much each worker gets paid. This could depend on the employee’s working time, pay, or a separate factor.

- Taxes and other deductions are taken from each employee’s pay by the business.

- The employer gives the government the money it needs for taxes and other deductions. The rest of each employee’s pay is put into their bank account or given to them as a paycheck.

OnlineCheckWriter.com – Powered by Zil Money, the best platform for managing your company’s money, lets you handle payroll in one place.

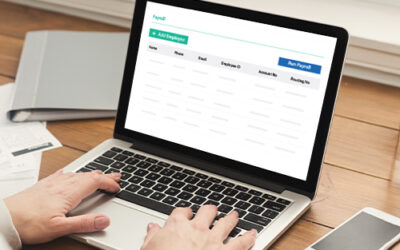

What Is Payroll Software?

Payroll software is a type of software that handles payroll and can be hosted locally or in the cloud. Payroll software that is dependable, fully integrated, and properly configured can assist businesses of all sizes in meeting tax and other financial regulations while reducing costs. OnlineCheckWriter.com has one of the best payroll software systems with additional functions and a variety of other features and integrations that will benefit your company. OnlineCheckWriter.com’s superior payroll system can benefit all businesses, large or small.

Benefits of Using Payroll Services

Payroll software is a powerful tool that can help streamline and automate the payroll process. Here are some of the key benefits of using payroll software for payroll services:

- Increased accuracy: Payroll software can perform complex calculations and automatically apply tax laws and regulations. This reduces the risk of human error and ensures that employees are paid accurately and on time. OnlineCheckWriter.com provides the best platform for managing your payroll without any errors.

- Time-saving: Payroll software automates many of the tasks associated with payroll, such as calculating hours worked, applying overtime rules, and calculating taxes and deductions. This saves time and allows payroll administrators to focus on more strategic tasks. Use our platform and save your precious time.

- Improved compliance: Payroll software can help ensure compliance with federal and state payroll regulations, such as tax laws and minimum wage requirements. This reduces the risk of penalties and fines for non-compliance.

- Better record-keeping: Payroll software can help maintain accurate records of employee hours, wages paid, taxes withheld, and other payroll-related data. This can be useful for audits and other compliance-related tasks.

- Easy access to information: With payroll software, employees can easily access their pay stubs, tax forms, and other payroll-related information online. This reduces the administrative burden on payroll administrators and can improve employee satisfaction.

- Integration with other systems: Many payroll software solutions integrate with other HR and accounting software, making it easier to manage payroll as part of a larger business process.

How our Platform OnlineCheckWriter.com Can Help You?

Payroll services and management using OnlineCheckWriter.com will simplify payroll management and other business finances. You can manage payroll, print payroll checks, make and manage invoices, send money via ACH, wire, direct deposit, or eCheck, and use several other features to make business finances easier. Our platform also provides in-build accounting software, accounting software integration, and integration with more than 22,000 banks.

You can print professional payroll checks on check stock paper with any standard printer from your home or office. Using our platform to print checks instantly can save you both money and time. You can also use our drag-and-drop design tool to make your personalized check easily.

Payroll services are a crucial component of running a business. With payroll software, businesses can automate many time-consuming and complex tasks involved in payroll management, such as calculating employee salaries and taxes, generating pay stubs, and reporting payroll information to the government. Payroll software like OnlineCheckWriter.com also reduces the risk of errors and ensures compliance with state and federal payroll regulations. So, why wait? Sign up and enjoy all the benefits.