Transferring money, paying your Internet bill with direct debit, depositing your paycheck. All these sending and receiving payments rely heavily on your bank account number. However, it can be difficult to find the account number, get confused with the routing number, and understand how it works when we need to make a transaction. This article tells you what an account number is and how to find one.

Bank Account Number

Bank account numbers identify your account within any existing banking institution. It’s similar to a money ID card. This specific chain of numbers enables third parties (your company, service providers, or other users) to transfer money or charge you for services without fear of sending or billing the money to the wrong person.

Your bank account number has 24 characters: Twenty of them are the customer account code (CAC), unique to each individual in any bank. Two characters are control numbers, and the other two indicate the country where the bank account is located.

The 24 characters of a normal bank account number are follow:

- Country reference code. Control numbers are indicated by two letters that are part of the country’s full name.

- Control numbers. These two numbers correspond to the letters indicating the country where the bank account is located.

- Current account number. The remaining 20 characters denote:

- The bank code. This field indicates which bank the account is in.

- Sort code. The branch where the bank account number was opened.

- Control numbers. These are the two numbers used to validate the account.

- Account number. The bank assigns a ten-character string to identify the account. There can never be two numbers that are the same.

Routing Number vs Account Number

You will need your bank’s routing and account numbers when you do any financial transaction online or by mail, like setting up direct deposits like your paycheck or ordering checks.

A customer’s account number functions similarly to a unique identification number or fingerprint. Both the sending and receiving accounts are identified by their respective routing and account numbers.

Similarly, routing numbers serve as a numeric identifier for each financial institution. For instance, if you want to send money electronically, you’ll need to give your routing and account numbers to the receiving bank and the sending bank.

The length of a routing number is always nine digits, while the size of an account number typically ranges from nine to twelve digits.

What Is an International Bank Account Number (IBAN)?

An international bank account number, or IBAN, is a unique identifier for a bank account in a foreign country. The first two digits are a country code, followed by two more numbers and a string of letters and numbers. An international bank account number (IBAN) is intended to supplement a bank’s existing account number to identify monetary transactions made in a foreign country.

IBAN vs SWIFT Code

International Bank Account Numbers (IBANs) and SWIFT (Society for Worldwide Interbank Financial Telecommunication) codes make international money transfers easier.

Society for Worldwide Interbank Financial Telecommunication (SWIFT) codes are used to find a certain bank during an international transaction.

An International Bank Account Number (IBAN) is used in international transactions to find a specific account.

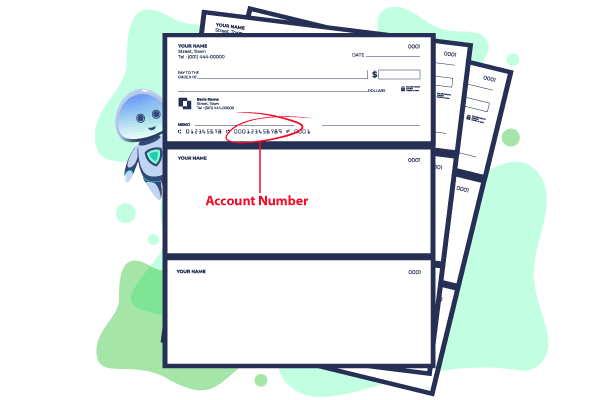

How Do You Find the Account Number on Check?

Your bank account number can be found at the bottom of your paper check. The second set of numbers appears between the nine-digit routing numbers. The check number is sometimes written in an unusual place. Choose the longer number to find out what your account number is. This is a unique number associated with your bank account. It can only be obtained through checks or logging into your online account. This number is also on your account statement.

Print Routing, Check and Account Number Using OnlineCheckWriter.com

Use OnlineCheckWriter.com – Powered by Zil Money to print your checks on-demand with routing, check, and account number on blank or regular paper without wasting your time or money. Using our platform’s drag-and-drop design tool, you can make your own checks and change the look of existing checks or start from scratch. You can also send digital checks through email or the ACH network.

A bank account number is a unique identifier for each account you have. Payments and deposits are made using this number and the routing number. Keep your account number and other banking information safe. Without wasting time, print your check with the routing, check, and account numbers on blank stock paper using OnlineCheckWriter.com!