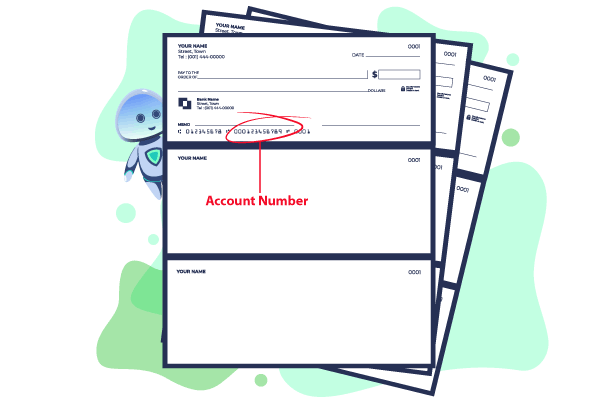

In the digital world, physical checks may seem outdated, but they still play a crucial role in financial transactions. Regarding checks, several key elements need attention, including the account number. Located at the bottom of the check, between the routing and check numbers, is account number on check. OnlineCheckWriter.com – Powered by Zil Money help you to print the account number on the check effortlessly.

Numbers in a Check

The account number, check number, and routing number are important components of a check. The account number uniquely identifies the bank account associated with the check, enabling accurate allocation of funds. The check number, typically located in the top right corner, helps track and distinguish individual checks for record-keeping purposes. The routing number, found at the bottom left of the check, identifies the bank and specific branch where the account is held. It aids in routing the check to the correct financial institution for processing. Understanding the positions of these numbers on a check is vital for accurate identification, tracking, and secure transfer of funds.

The Account Number’s Location and Significance

The account number on a check is typically found at the bottom of the check, between the routing number and the check number. It serves as a unique identifier for the account owner and is vital for accurate processing of transactions. Depending on the financial institution, account numbers can vary in length, ranging from 9 to 18 digits. Understanding the significance of the account number with OnlineCheckWriter.com is essential to appreciate the need for confidentiality. Revealing this information can expose individuals or businesses to the risk of fraudulent activities, including unauthorized access to funds, identity theft, fraud, and unauthorized transactions.

Protecting Account Numbers with OnlineCheckWriter.com

OnlineCheckWriter.com, a trusted brand in check management solutions, recognizes the importance of keeping account number confidential on check. Therefore, they offer robust security measures to safeguard sensitive financial information.

- Secure Account Management: The platform provides a secure management platform for check-related tasks. With their user-friendly interface, you can easily input and store account numbers, ensuring they remain protected from unauthorized access.

- Advanced Encryption: The platform employs advanced encryption protocols to ensure data security. With these security features, the sensitive personal and financial information of users is safe on the platform.

- Multi-Factor Authentication: The platform prioritizes user security by implementing multi-factor authentication. This will prevent unauthorized access to your account.

- Restricted Access: The platform grants access to authorized person only. OnlineCheckWriter.com allows you to assign specific privileges to individuals within your organization, ensuring that account numbers are only accessible to those who require the information for legitimate purposes.

- Secure Check Storage: The platform offers secure digital storage for check-related documents. Securely storing your checks and associated account numbers eliminates the risk of physical document loss or theft.

Conclusion

The account number on a check is highly significant as it identifies the account owner and ensures accurate transaction processing. Protecting this information from potential fraud is vital. OnlineCheckWriter.com understands the importance of account number confidentiality and provides robust security features to safeguard sensitive financial data. By utilizing their secure platform, advanced encryption, multi-factor authentication, restricted access, and secure document storage, individuals and businesses can rest assured that their account numbers remain protected.